- BitMine now holds 1.77M ETH in staking, worth over $5.6B.

- Ethereum staking entry queues hit a multi-year high.

- Falling exit queues may reduce short-term ETH selling pressure.

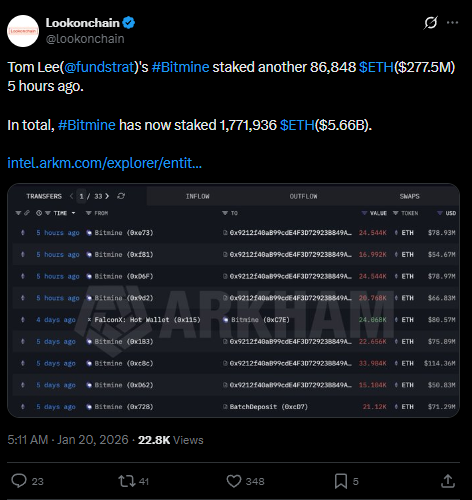

BitMine, the Ethereum treasury firm chaired by market strategist Tom Lee, has significantly expanded its exposure to Ether by staking another large batch of ETH. The latest move reinforces the company’s ambition to dominate crypto staking while adding fresh momentum to Ethereum’s on-chain narrative.

BitMine Stakes Nearly $280M in Fresh Ether

According to recent disclosures, BitMine staked an additional 86,848 ETH, valued at roughly $277.5 million at current prices. This pushes the firm’s total staked Ether holdings to 1.77 million ETH, worth an estimated $5.66 billion.

With most of its ETH now locked into staking contracts, BitMine remains the largest Ethereum treasury holder globally. Tom Lee has said the firm aims to become the largest staking provider across crypto markets, projecting annual staking revenue of around $374 million, or more than $1 million per day, based on current reward rates.

The company is backed by major institutional players, including Founders Fund and ARK Invest, underscoring continued institutional confidence in Ethereum’s long-term yield and infrastructure.

Ethereum Staking Demand Hits Multi-Year High

BitMine’s move comes as Ethereum staking demand accelerates across the network. As of Jan. 20, the staking entry queue climbed to roughly 2.7 million ETH, the highest level since mid-2023.

At the same time, the staking exit queue has dropped sharply, marking its first sustained decline since mid-2025. Analysts note that fewer exits reduce near-term selling pressure, as less Ether is scheduled to re-enter circulation.

On-chain data also shows active positioning elsewhere. A newly created wallet withdrew 3,300 ETH—worth about $10.5 million—from Bybit, adding to signs of strategic accumulation as ETH trades near key technical levels.

Surge in Activity Raises Security Questions

Ethereum’s network activity has spiked sharply over the past month. Active addresses reportedly doubled to 8 million, while daily transactions exceeded 2.8 million. However, not all of this growth may be organic.

Security researcher Andrey Sergeenkov warned that part of the surge could be driven by address poisoning attacks, a form of wallet spam that became cheaper after network fees fell more than 60% following December’s Fusaka upgrade.

Also Read: BitMine Stakes $625M in ETH, Pushing Holdings Past 1.5M — What’s Next?

While spam-related activity clouds some metrics, rising staking demand and reduced exit pressure point to growing long-term conviction. BitMine’s aggressive strategy highlights how institutional players are increasingly treating Ethereum not just as a speculative asset, but as a yield-generating backbone of crypto finance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.