- Early XRP accumulation was driven by low prices, not fixed benchmarks.

- Cost basis heavily influences perceptions of “large” XRP holdings.

- XRPL’s move into native lending could reshape XRP’s long-term utility.

As XRP trades at levels that once seemed out of reach, a familiar question has returned to the spotlight: how much XRP is enough for a long-term portfolio? The debate has intensified alongside growing excitement around the XRP Ledger’s push into native lending, a development that could reshape how investors think about utility, demand, and long-term value.

Recent commentary from within the XRP community suggests that the answer is less about hitting a specific number and more about timing, cost basis, and personal financial strategy.

Early Buyers vs. Today’s Market Reality

XRP community commentator Oscar Ramos recently weighed in on the discussion, arguing that there is no universal benchmark for an “ideal” XRP holding. According to Ramos, comparisons between early adopters and newer investors often ignore one critical factor: price.

Many long-time holders accumulated XRP when it traded well below $1. At those levels, building a large position required far less capital than it does today. With XRP now hovering around the $2 range, matching those early holdings would demand multiples of the original investment.

That shift, Ramos noted, has nothing to do with conviction or belief in the asset. It’s simply the math of a higher price.

Why Cost Basis Shapes Perception

Ramos emphasized that cost basis plays a central role in how investors perceive portfolio size. Wallets that appear “large” today often reflect favorable entry points rather than exceptional buying power.

As XRP matures and adoption expands, accumulating significant quantities is likely to become even more capital-intensive. For newer participants, anchoring expectations to past market conditions can create unnecessary frustration and unrealistic goals.

Instead, Ramos urged investors to evaluate XRP within the context of their broader financial plan, rather than chasing numbers tied to a different market era.

XRPL Lending Could Change the Value Conversation

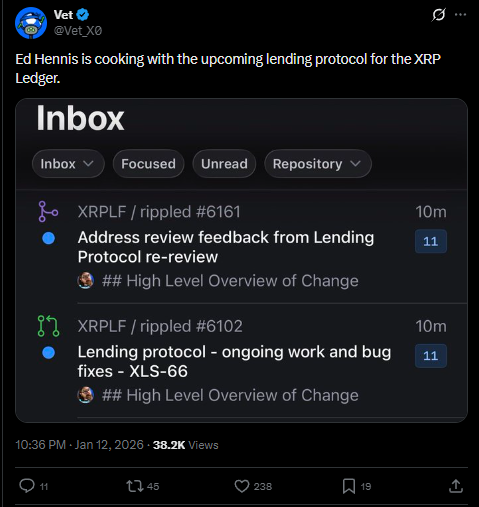

At the same time, the XRP Ledger is moving beyond its traditional payments-focused identity. Progress on XLS-66, a proposal to introduce native fixed-term lending on XRPL, has sparked optimism about XRP’s expanding utility.

Recent updates to the lending codebase improved efficiency and maintainability, bringing the protocol closer to production readiness. If implemented, XLS-66 would enable predictable, on-chain credit markets using pooled liquidity, without relying on overcollateralization or complex smart contracts.

This evolution could support lending activity using XRP and Ripple’s RLUSD stablecoin, potentially increasing on-ledger demand and long-term relevance.

Despite the enthusiasm around XRPL’s technical progress, Ramos cautioned against letting bullish narratives dictate position sizing. Portfolio decisions, he argued, should be guided by personal risk tolerance and affordability—not by social comparisons or speculative projections.

As XRPL expands into lending and structured credit, XRP’s role may evolve, but the principle remains the same: what’s “enough” depends on individual circumstances, not community pressure.

Also Read: 3 Signals Point to XRP’s Next Major Move as Small-Caps Break Out

The XRP debate is shifting from accumulation targets to utility-driven value. With XRPL lending on the horizon and prices far above early-cycle lows, investors face a different landscape than those who came before. In that environment, disciplined strategy and realistic expectations may matter far more than hitting any predefined XRP number.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.