- Whale accumulation suggests long-term confidence despite flat price action.

- ETF inflows are tightening XRP’s circulating supply.

- Technical compression increases the odds of a volatility breakout.

As 2025 comes to a close, attention is already turning to where XRP could be headed in early 2026. Despite muted price action in recent months, the data beneath the surface tells a more nuanced story. On-chain metrics, ETF flows, and derivatives positioning suggest XRP may be entering a long compression phase—one that often precedes directional expansion.

While the spot price remains range-bound, structural signals indicate that XRP’s market profile is quietly strengthening.

Whale Accumulation Signals Long-Term Conviction

XRP’s daily chart continues to struggle near its 200-day EMA, but on-chain data points to steady accumulation rather than distribution. Over the past three months, taker buy volume has consistently outweighed sell pressure. This imbalance suggests buyers are absorbing supply methodically, not chasing short-term momentum.

Supporting this view, the 90-day Cumulative Volume Delta has flipped positive and continues to trend higher. Historically, sustained CVD growth during consolidation phases has often preceded sharp volatility expansions. In XRP’s case, the data reflects conviction-led positioning rather than speculative bursts.

Institutional-Scale Trades and ETF Inflows Tighten Supply

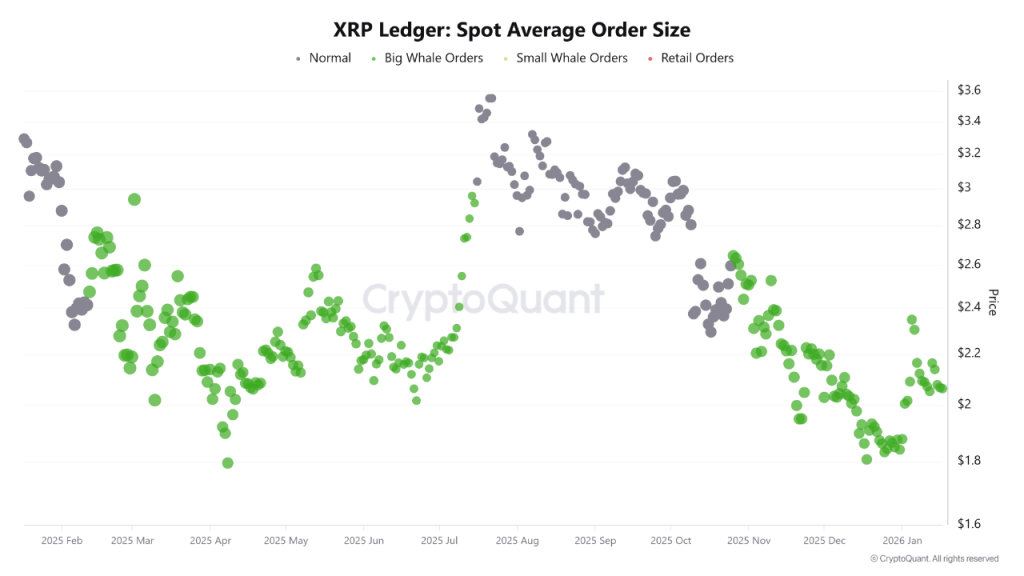

Another key signal comes from average order size data. Larger trades are becoming more frequent, indicating rising participation from whales or institutional players. This shift typically reflects strategic positioning rather than reactive trading.

ETF-related flows reinforce this narrative. Since November, XRP-linked ETFs have seen inflows far exceed outflows. Such behavior usually points to long-term allocation strategies, reducing available supply and strengthening the longer-term XRP price forecast heading into 2026.

Derivatives Data Shows Asymmetric Risk

While spot markets show accumulation, derivatives traders remain cautious. Funding rates are still negative, signaling that short positions dominate leveraged markets. This imbalance reflects lingering pessimism rather than overheated optimism.

Historically, prolonged negative funding has often aligned with local bottoms. Excessive short exposure can limit downside momentum, especially when spot demand remains firm. If funding rates begin to normalize or turn positive, XRP has a track record of responding with upside moves following extended compression.

From a technical perspective, XRP is coiling between roughly $2.00 and $2.40. Rejections near the 200-day EMA confirm this tight range, but the lack of follow-through to the downside aligns with bullish on-chain signals.

A decisive break above $2.40 could open the door toward $2.75 and potentially $3.00. Conversely, a loss of the $2.00 level would weaken the bullish thesis and reset expectations.

Also Read: How Much XRP Is Enough? Developers and CEOs Say the Answer Isn’t What You Think

XRP’s price may appear stagnant, but the underlying data suggests a market quietly repositioning. Whale accumulation, ETF inflows, and compressed derivatives sentiment point to a setup with asymmetric upside heading into January 2026—provided key technical levels hold.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.