- Momentum flipped as profit-taking and risk-off sentiment took over.

- Partnership news lacked immediate token utility, triggering a sell-the-news move.

- $0.010–$0.012 range likely decides PENGU’s next trend.

Pudgy Penguins’ PENGU token started the year with momentum, riding a burst of speculative interest that pushed price off the $0.009 area and toward early-January highs. That move didn’t last. As market conditions shifted and traders reassessed near-term catalysts, price action flipped from breakout to retracement, exposing how fragile sentiment can be in a risk-off environment.

Breakout Turns Into Distribution

Early buying lifted PENGU toward the low $0.01s on expanding volume, a sign of fast-moving capital chasing upside. But follow-through quickly weakened. Profit-taking set in, sell volume climbed, and price slipped below the $0.011 area—an inflection point that triggered clustered stops. The result was accelerated downside as buyers stepped back and sellers controlled the tape.

Technical signals echoed the shift. Heavy red volume bars suggested distribution rather than a healthy pullback. Momentum indicators leaned bearish, with MACD extending lower and RSI dipping into oversold territory. That alignment reinforced downside pressure across short timeframes.

Partnership Expectations Fade

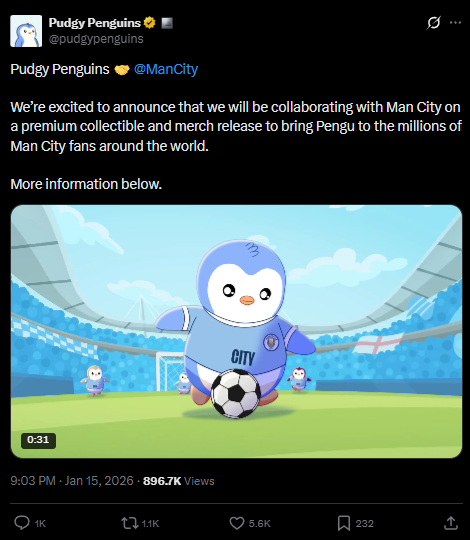

Speculation intensified ahead of Pudgy Penguins’ much-anticipated Manchester City partnership, announced mid-January. Investors priced in brand exposure and potential adoption, but the details emphasized a gradual rollout—NFTs and merchandise first, with cultural integration and longer-term revenue later. With no immediate token utility tied to the deal, the market sold the news.

As leverage unwound and spot demand cooled, PENGU slipped 4–5% on the day and roughly 15% from early-January highs. The move looked more like sector rotation than panic, mirroring broader memecoin weakness as traders moved defensively.

Key Levels to Watch: $0.010–$0.012

Near-term direction hinges on liquidity and sentiment around a tight range. Failure to hold $0.010 risks another dip toward the $0.009–$0.0095 zone, an area tied to prior consolidation. On the upside, bulls need to reclaim $0.0115, then push through $0.012, to signal sell pressure has been absorbed.

Until one side breaks decisively, PENGU is likely to trade reactively—less driven by headlines and more by broader memecoin flows and risk appetite.

Also Read: ETF Delays Can’t Stop Institutions: Why Smart Money Is Buying PENGU and Bitcoin Now

PENGU’s pullback underscores a familiar pattern: hype can move price quickly, but sustainability depends on follow-through, liquidity, and market mood. For now, patience around key levels may matter more than chasing narratives.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.