- Injective approved a major tokenomics upgrade with 99.89% community support.

- The new plan halves emissions and increases buybacks to accelerate deflation.

- Despite the update, INJ price remains driven by broader market conditions.

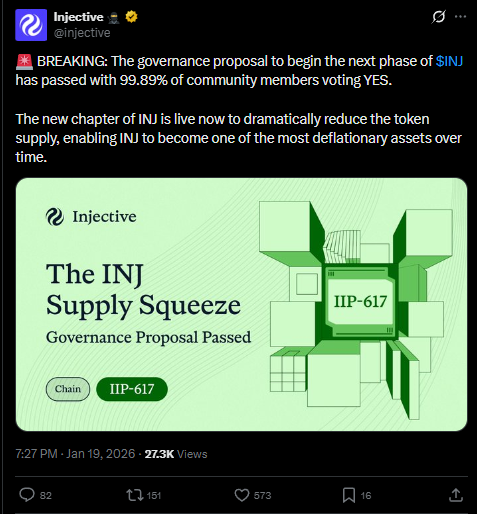

Injective is pressing ahead with a major shift in its token economics after the community overwhelmingly approved a new deflationary proposal. Dubbed the “supply squeeze,” the plan signals a more aggressive effort to shrink INJ’s circulating supply, even as broader market weakness continues to weigh on prices.

Injective Community Backs Supply Squeeze

The proposal, formally known as IIP-617, passed with near-unanimous support, with 99.89% of votes in favor. It marks a structural upgrade to Injective’s tokenomics and builds on the network’s existing buyback-based deflation strategy.

Injective launched with a fixed supply of 100 million INJ, with the token serving as the governance asset for the Layer-1 ecosystem. Until now, deflation was driven mainly through fee-based buybacks. More than 6.8 million INJ have already been removed from circulation through that program.

The new plan aims to accelerate this process by doubling the supply reduction rate. In practical terms, Injective will slash token emissions by 50% while increasing buybacks, tightening supply from two directions at once.

How the New Tokenomics Work

INJ’s emissions are tied to staking participation and typically fluctuate between 5% and 10% annually, depending on whether the network maintains an 85% staking ratio. By cutting emissions in half, Injective reduces the number of new tokens entering circulation, complementing its existing buyback mechanism.

Supporters see this as a cleaner, more predictable approach to long-term value accrual. The idea is to reduce reliance on market conditions alone and introduce a fixed structural element that steadily pressures supply lower over time.

Mixed Views on Buybacks Across Crypto

Not everyone in the crypto space agrees that buybacks are a silver bullet. Similar programs across other ecosystems have delivered uneven results. Some communities view them as an efficient way to return value to token holders, while others argue they waste capital if prices fail to respond.

Injective’s dual strategy — fewer emissions plus larger buybacks — is designed to address those criticisms. Whether it proves more effective than past efforts elsewhere remains an open question.

Despite the bullish tokenomics update, INJ’s price action has remained closely tied to broader market trends. The token briefly rose around 4% after the announcement but later gave back gains as Bitcoin slid toward $90,000 amid renewed macro pressure.

INJ recently dipped below $5, briefly touching support near $4.4. Futures data also suggests muted trader interest, with open interest flat around $25 million and cumulative volume delta staying negative.

Also Read: Dogecoin Near Critical Breakout: Is a 290% DOGE Rally Next?

Injective’s supply squeeze marks one of the more aggressive deflationary moves among Layer-1 networks. While the long-term impact could be meaningful, current price action shows that macro sentiment still dominates. Whether INJ’s fundamentals eventually translate into stronger demand is a question the market has yet to answer.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.