- SHIB’s burn surge failed to spark a short-term price rally.

- Avalanche network usage hit record highs despite AVAX weakness.

- Market sentiment and rotation are overriding fundamentals for now.

Shiba Inu and Avalanche both delivered eye-catching on-chain signals this week. Yet despite a dramatic SHIB burn spike and record-breaking Avalanche network activity, neither token has managed to escape broader market weakness. The disconnect highlights a familiar crypto theme: fundamentals can strengthen while prices lag.

Shiba Inu Burn Rate Explodes, Price Slips Anyway

Shiba Inu’s burn rate jumped more than 3,900% in the past 24 hours, permanently removing nearly 30 million SHIB from circulation. In theory, supply reduction should support price strength over time. In practice, SHIB moved the opposite way.

The memecoin dropped roughly 6% over the same period, sliding to around $0.00000786. The move came despite long-term progress on supply reduction, with over 410 trillion SHIB now burned from the original supply.

Recent on-chain data suggests whale behavior may still shape near-term price action. Large holders have reduced exchange balances significantly, a trend that typically signals accumulation. Some analysts believe a recovery toward the 200-day EMA near $0.0000105 remains possible if sentiment improves, but current price action shows patience is required.

Investor Attention Shifts to Maxi Doge Presale

While SHIB struggles to react, some speculative capital appears to be rotating into newer memecoin projects. Maxi Doge (MAXI), another dog-themed token, has emerged as a notable presale winner in early 2025.

The project has raised roughly $4.5 million so far, reflecting strong early demand. With a low entry price and multiple payment options, Maxi Doge has positioned itself as a higher-risk, higher-upside alternative for traders seeking fresh momentum rather than waiting on established tokens.

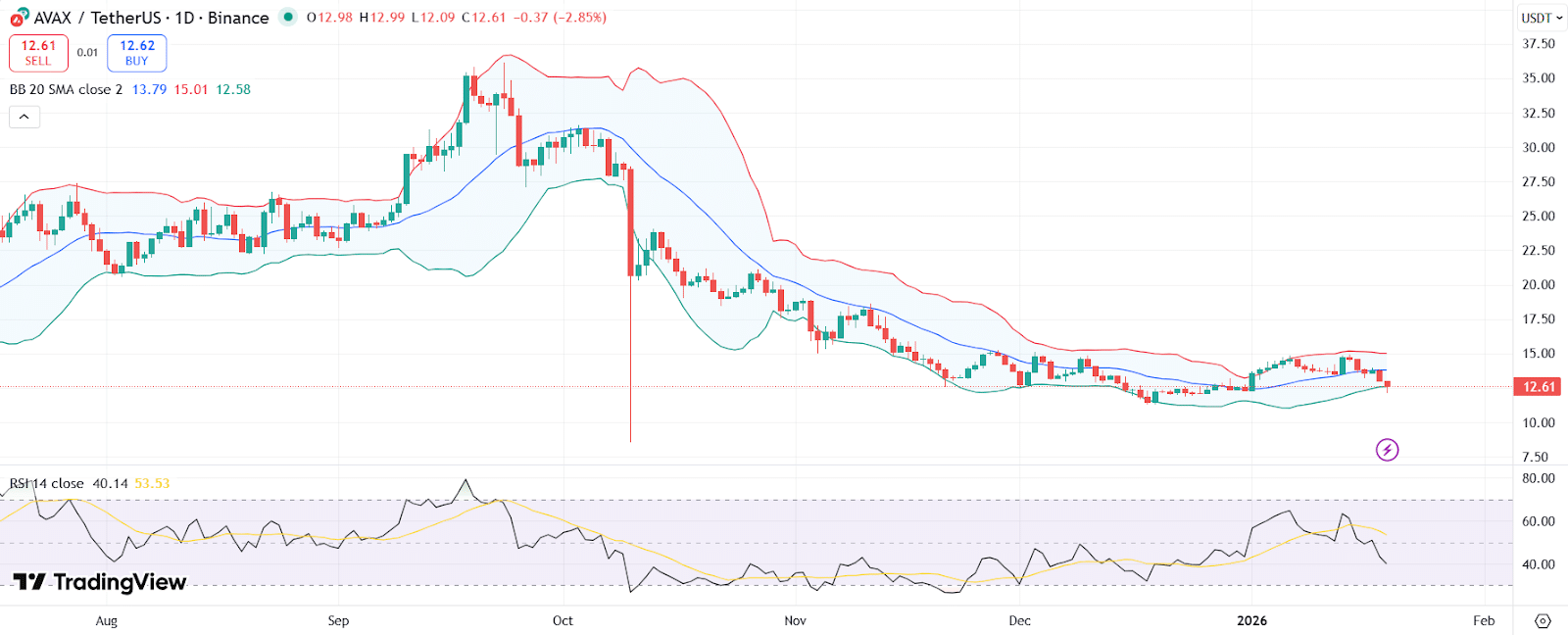

Avalanche Network Hits Records as AVAX Weakens

Avalanche tells a similar story of strong fundamentals clashing with weak price performance. On Jan. 19, daily active addresses on Avalanche’s C-Chain surged to a record 1.71 million, far above historical averages.

The network has become significantly more efficient over the past year, with transaction counts and user activity rising sharply. Fast finality, low fees, and high throughput continue to support real-world usage.

Also Read: Shiba Inu Dips But Ethereum Soars: What Traders Must Know

Despite this, AVAX fell more than 7% in a single day and remains well below last year’s highs. Technical indicators show the token hovering near key support around $12, with downside risk toward $10.50 if selling pressure persists. A recovery above $13.80 would be the first sign of renewed bullish momentum.

Shiba Inu and Avalanche both demonstrate that strong on-chain metrics do not guarantee immediate price gains. In a cautious market, traders are prioritizing liquidity, sentiment, and rotation into new narratives. Until conditions improve, fundamentals may continue to build quietly while prices search for a clearer direction.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.