Bank of America is reportedly fast-tracking the development of its own U.S. dollar-backed stablecoin. Once hesitant, the banking behemoth now appears ready to compete head-on with blockchain-native platforms, marking a pivotal shift in the financial sector’s digital asset strategy.

Speaking at a recent Morgan Stanley conference, Bank of America CEO Brian Moynihan highlighted the regulatory uncertainties that had stalled their blockchain ambitions. “The technology has been understood for some time—what held us back was the regulatory fog,” Moynihan stated. “It wasn’t clear we were even permitted to move forward under existing banking rules.”

JUST IN: 🇺🇸 Bank of America CEO says the bank is working on stablecoin on its own and with industry. pic.twitter.com/MNSpERVvMH

— Whale Insider (@WhaleInsider) June 11, 2025

This strategic pivot comes as legacy institutions face mounting pressure from fintech competitors and peer banks like JPMorgan Chase, which have already begun piloting blockchain-based settlement solutions. For Bank of America, a stablecoin could serve as a gateway to faster cross-border payments and lower settlement costs.

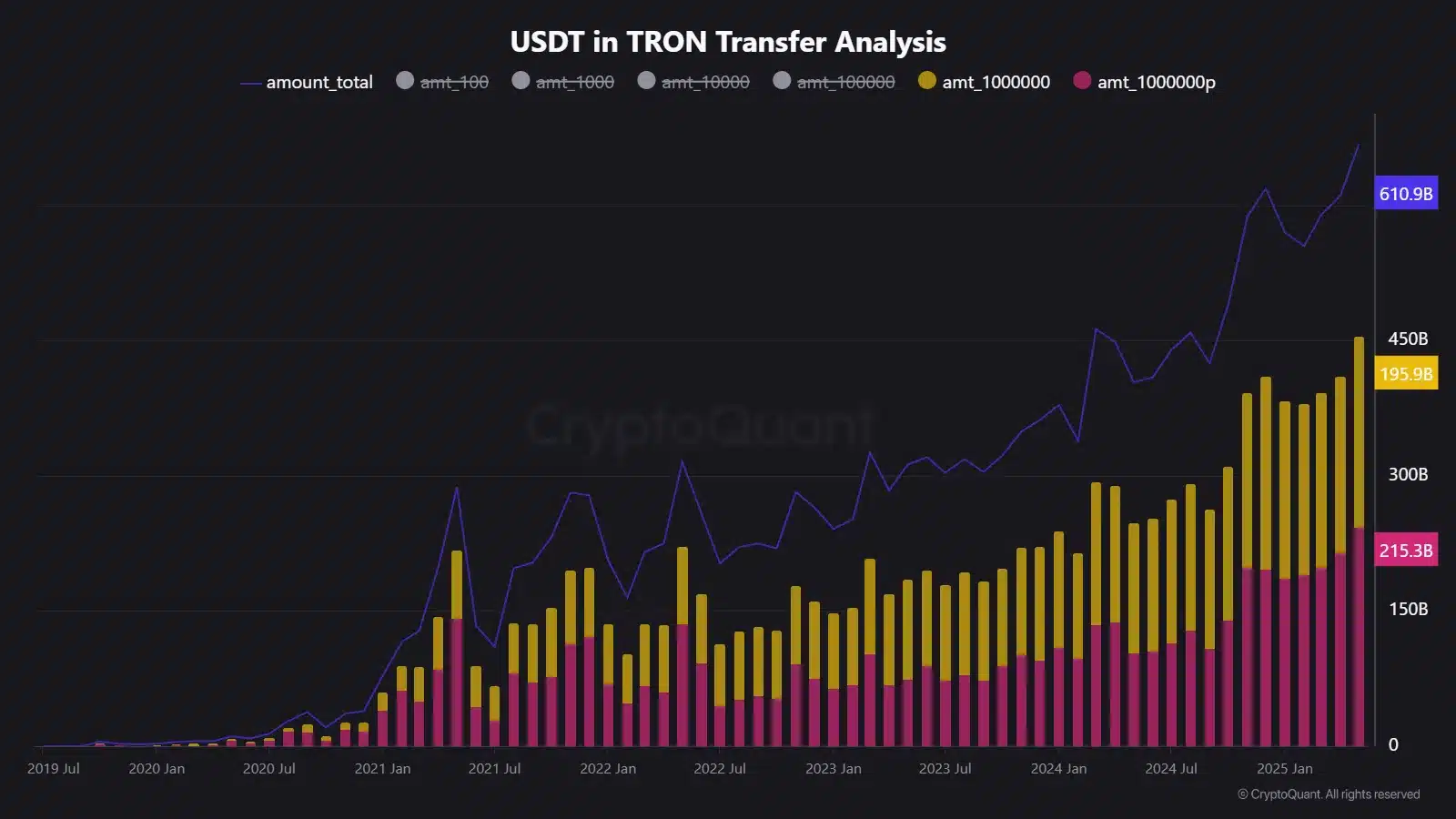

Meanwhile, TRON [TRX] has surged ahead in the stablecoin arena, processing a staggering $694.54 billion in USDT transfers during May 2025 alone. According to CryptoQuant, over $411 billion of that volume came from whale transactions—transfers exceeding $1 million—underscoring TRON’s role as a preferred network for high-volume stablecoin movement.

With more than 17 separate $1 billion-plus USDT mints already in 2025 and over 10.5 billion cumulative transactions, TRON now commands over $75 billion in TRC-20 USDT, making it the undisputed leader in stablecoin liquidity and usage.

As the stablecoin ecosystem rapidly evolves, the stakes are rising globally. In emerging markets, U.S. dollar-pegged stablecoins are being embraced for remittances and inflation hedging, effectively extending the dollar’s reach. At home, the Federal Reserve faces growing calls to clarify its regulatory stance, especially amid concerns over stablecoins’ influence on Treasury markets.

Also Read: TRON’s TRX Nears Breakout as Whale Accumulation Grows

With central banks worldwide accelerating central bank digital currency (CBDC) pilots, it’s clear the stablecoin race is reshaping not just finance—but monetary policy itself. For both Wall Street and the blockchain world, the competition is only just beginning.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.