The ongoing Bitcoin downtrend may be influenced by short-term holders (STHs), who appear to be changing their stance as the market shifts. Their hesitation in taking profits or cutting losses could dictate Bitcoin’s next major price movement.

Bitcoin Investors Fear Losses

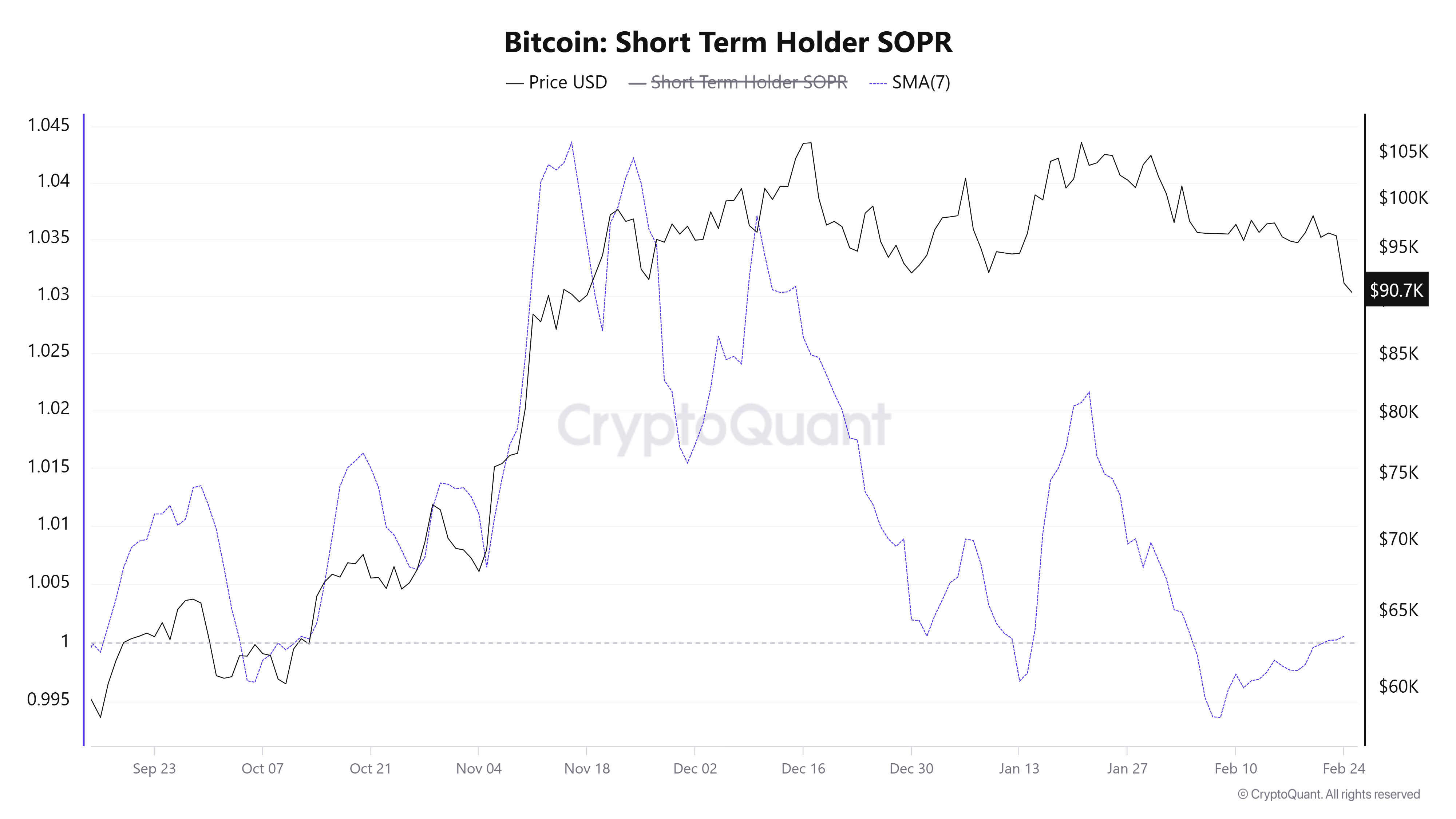

The Short-Term Holder Spent Output Profit Ratio (STH SOPR) indicator is struggling to reclaim the bullish threshold of 1.0. Staying above this level suggests that STHs are making profits and willing to hold, while a failure to do so signals growing sell pressure. If the SOPR remains below 1.0, more STHs could offload their holdings, potentially driving Bitcoin’s price even lower.

Historically, STHs are known for their quick trading behavior, and their mass selling can lead to sharp price declines. The current failure of the SOPR to cross 1.0 indicates a rising bearish sentiment. This could result in Bitcoin slipping below the crucial $90,000 level, prolonging the ongoing market downturn.

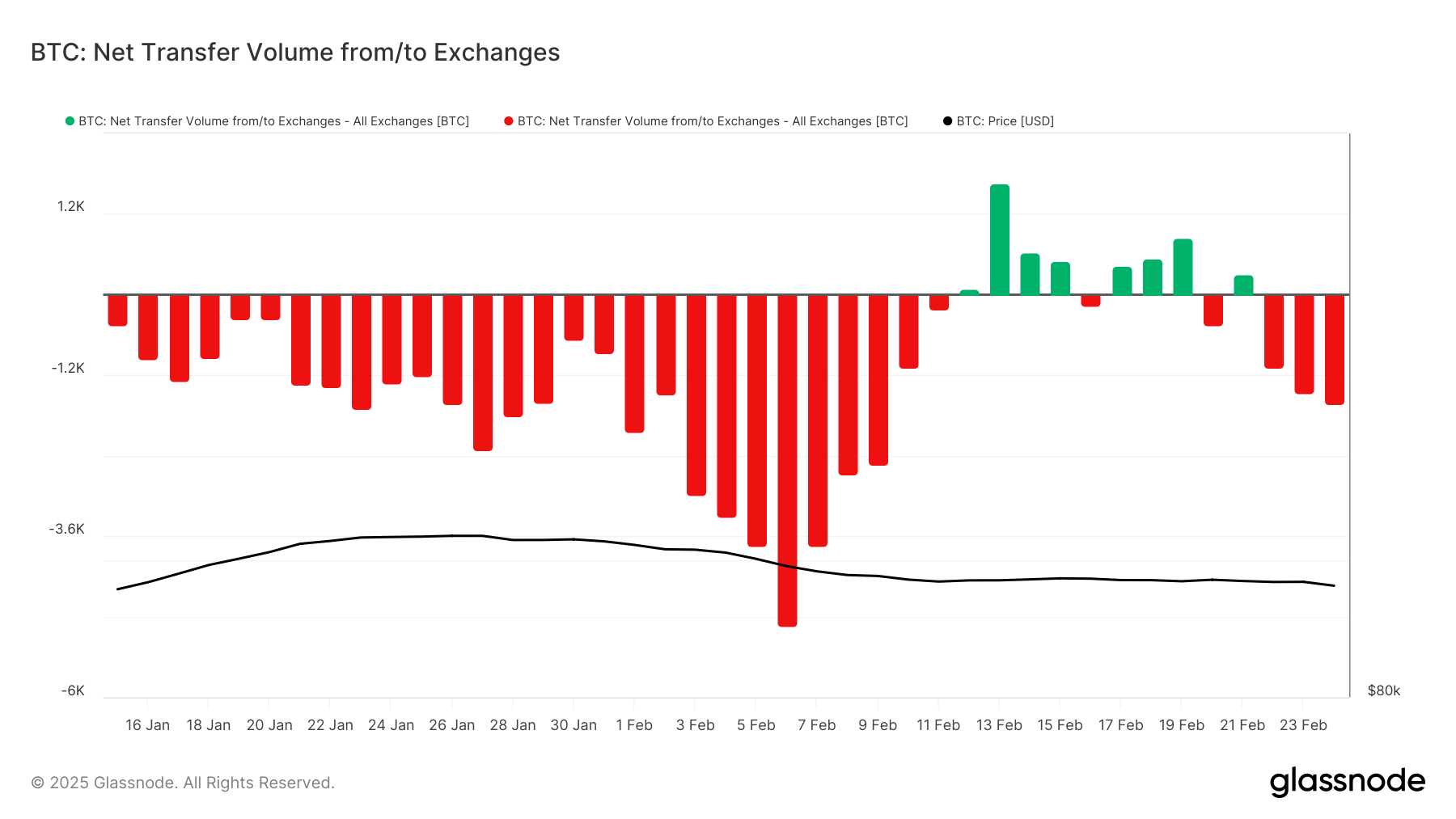

However, despite Bitcoin’s sharp 8% decline in the last 24 hours, exchange netflows indicate a lack of significant BTC withdrawals. Only 157 BTC (worth $14 million) left exchanges in the past day—far from the expected panic-driven sell-off. This suggests that some STHs are holding onto their assets, possibly anticipating a recovery.

BTC Price Continues to Fall

Bitcoin currently trades at $88,449—its lowest level since November 2024. The price crash has led to the loss of a key downtrend line support, which had been intact for over a month. Bitcoin’s immediate support now lies at $87,041. If this level holds, a rebound could push BTC toward $89,800 and potentially $92,005, signaling a reversal in market sentiment.

However, if Bitcoin fails to maintain support at $87,041, a deeper drop to $85,000 could follow. Such a decline would invalidate any hopes for a near-term recovery, reinforcing bearish dominance in the market.

Also Read: Bitcoin Faces Uncertainty: Will Bulls Prevent a Drop to $90K as Volatility Hits Record Lows?

As market conditions evolve, investor sentiment and STH behavior will play a critical role in determining Bitcoin’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.