- Asian holidays typically suppress Bitcoin liquidity early October.

- U.S. government shutdown adds risk of sudden price swings.

- Solana ETF setup may outperform Litecoin amid Grayscale overhang.

Bitcoin traders may face a volatile start to October as thin Asian liquidity coincides with a partial U.S. government shutdown, raising the stakes for short-term price swings. Historically, early October sees muted action in the world’s largest cryptocurrency, but this year’s unusual macro factors could disrupt the norm.

Asian Holidays Damp Bitcoin Activity

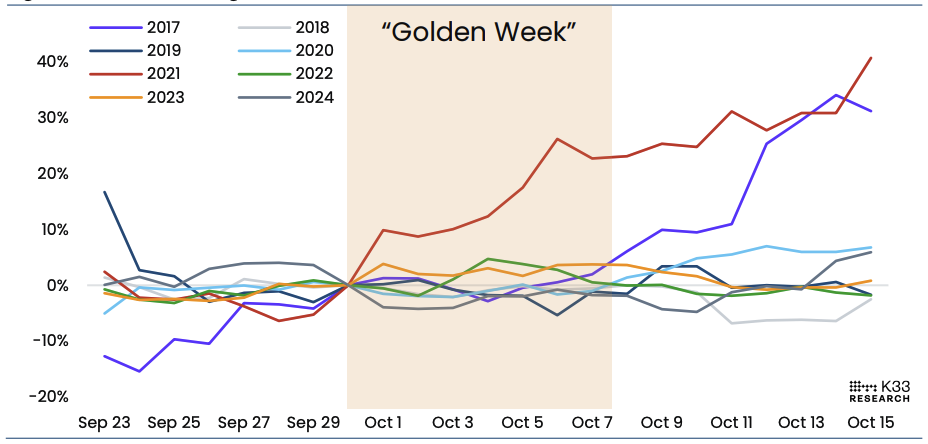

China’s Golden Week, starting October 1, overlaps with South Korea’s market closures from October 3 to 9, creating a period of low regional participation. K33 research highlights that Bitcoin typically shows flat or slightly negative returns during this period, with volatility compressing toward local lows. “BTC typically behaves flat during the early October Asian holiday season,” said K33 Head of Research Vetle Lunde. August through mid-October generally sees muted price action, reinforcing the seasonal lull.

U.S. Shutdown Adds Volatility Risk

The recent partial shutdown of the U.S. federal government adds a new layer of uncertainty. Furloughed workers and delayed economic reports, including jobs and inflation data, could leave traders exposed to erratic price movements. Thin order books, combined with already muted Asian flows, may amplify volatility during overlapping sessions, particularly in the first week of October.

Market Dynamics and ETF Outlook

Despite the seasonal slowdown, Bitcoin has remained in consolidation, trading around $116,412 after a September rebound. Derivatives metrics point to caution: CME open interest is at five-month lows, funding rates remain below neutral, and options traders favor puts.

Attention is also shifting to altcoins as the SEC moves toward approving spot ETFs for Solana and Litecoin. K33 notes that Solana’s ETF setup presents low risk of forced selling, while Litecoin could see pressure due to Grayscale controlling 2.65% of its circulating supply. Analysts suggest a “long SOL, short LTC” strategy may emerge if ETFs launch concurrently.

Also Read: France’s €168B Deficit Could Trigger ECB Money Printing and Boost Bitcoin

Traders should brace for a unique mix of seasonal slowdowns and sudden volatility. While Asian sessions often underperform, U.S. trading hours have historically driven Bitcoin’s most significant gains. The overlapping holidays and shutdown make early October a critical period to watch for short-term price swings.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.