Bitcoin [BTC] is showing signs of a market transition, as several on-chain metrics signal a shift from accumulation to caution. While the cryptocurrency remains in a momentum-driven uptrend, new developments suggest that the easy phase of the rally may be behind us. With BTC trading above $109,000 at press time, traders must now weigh the emerging risks against potential rewards.

Exchange Reserves and Whale Behavior Raise Eyebrows

Bitcoin’s Exchange Reserve USD has climbed 3.45% to over $273 billion, indicating increased coin availability on trading platforms. This rise often precedes heightened volatility or downward corrections, suggesting that some investors may be preparing to sell into strength. Simultaneously, the Miners’ Position Index (MPI) spiked over 96%, reflecting rising outflows from miners—although still below fully bearish levels. Additionally, the Exchange Whale Ratio points to consistent inflows from large holders, reinforcing the possibility of a brewing distribution phase. These indicators combined highlight growing caution among key market participants.

Unrealized Gains Suggest Profit-Taking Risk

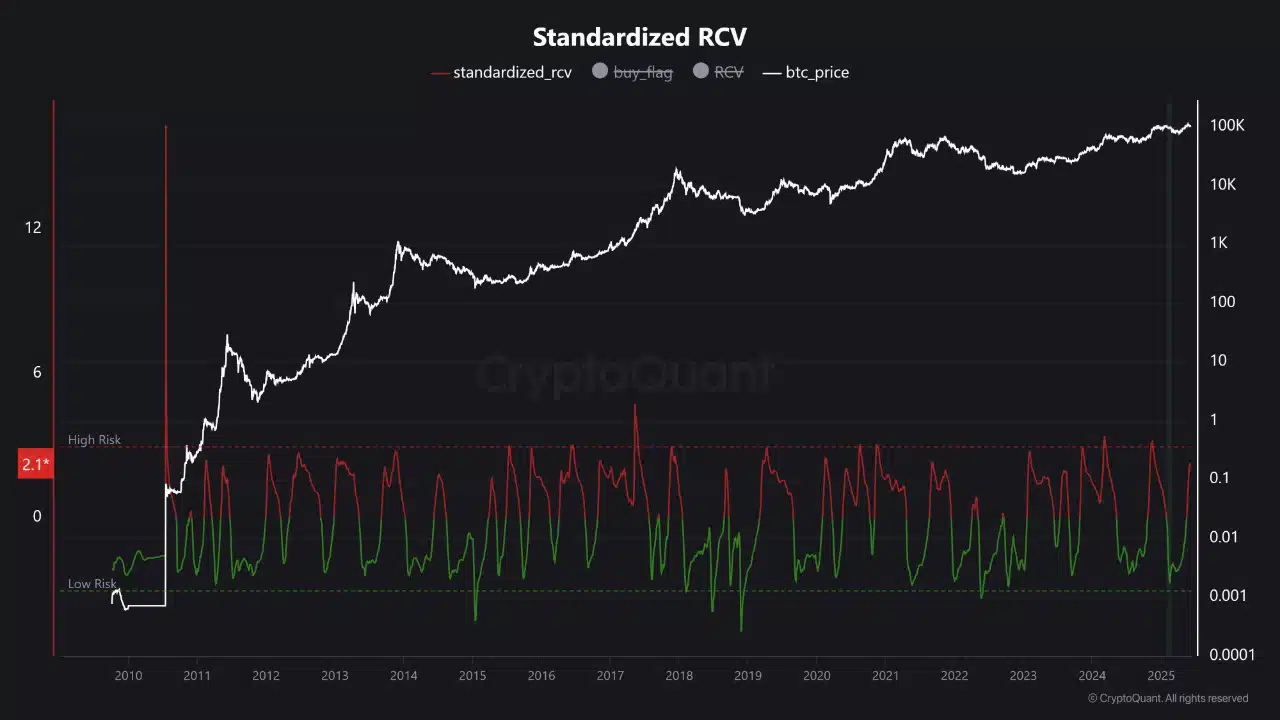

Another warning comes from the MVRV Ratio, which has surged 3.88% to 2.32. This metric shows that most holders are now sitting on substantial unrealized profits. Historically, when MVRV climbs above 2, profit-taking behavior tends to accelerate, often leading to short-term pullbacks. While not an outright bearish signal, it reflects a growing temptation among holders to lock in gains—especially as earlier buy signals from the 60-day Realized Cap Variance (RCV) have disappeared.

Network Activity Hints at a Valuation Disconnect

On-chain usage metrics offer a more nuanced picture. The NVT and NVM ratios have declined sharply—by 31% and 24% respectively—suggesting improved transaction activity relative to market cap. However, these drops may also reflect a potential disconnect between price and actual utility. If BTC’s network activity fails to keep pace with valuation, it could add pressure to an already cautious market environment.

Also Read: Publicly Traded Firms Boost Bitcoin Holdings by 16% in Q1 2025: Bitwise

While Bitcoin hasn’t entered a full-fledged distribution phase, risk indicators are flashing. With accumulation conditions fading and internal pressures mounting, traders should remain vigilant. The bullish trend is still intact, but a reassessment of positioning may be prudent as Bitcoin navigates this evolving market landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.