- Bitcoin remains in consolidation, not a confirmed downtrend.

- Strong sell walls near $95K are capping short-term upside.

- Institutional activity continues to support the long-term outlook.

Bitcoin has pulled back modestly after setting a fresh yearly high near $94,700, slipping toward the $92,000–$93,000 range. The move has unsettled short-term traders, especially as it came days after strong inflows into spot Bitcoin ETFs. Still, many analysts see the pause less as a breakdown and more as a cooling-off period following an aggressive run higher.

Veteran trader Matthew Dixon describes the recent dip as a textbook correction rather than a sign of deeper weakness. Price action, momentum indicators, and on-chain behavior all suggest Bitcoin is consolidating — not rolling over.

Technical Structure Still Favors the Bulls

From a charting perspective, Bitcoin’s pullback fits a common post-rally pattern. The price has retraced in an orderly way, forming a corrective structure that typically reflects profit-taking instead of panic selling. Momentum indicators, including the RSI, have reset from stretched levels, easing prior overheating.

Importantly, long-term holders appear to be sitting tight. At the same time, medium-term investors are stepping in on dips near key levels, reinforcing the idea that demand remains intact beneath the surface. As long as daily closes hold above the broader $82,000–$85,000 support zone, the larger uptrend remains structurally sound.

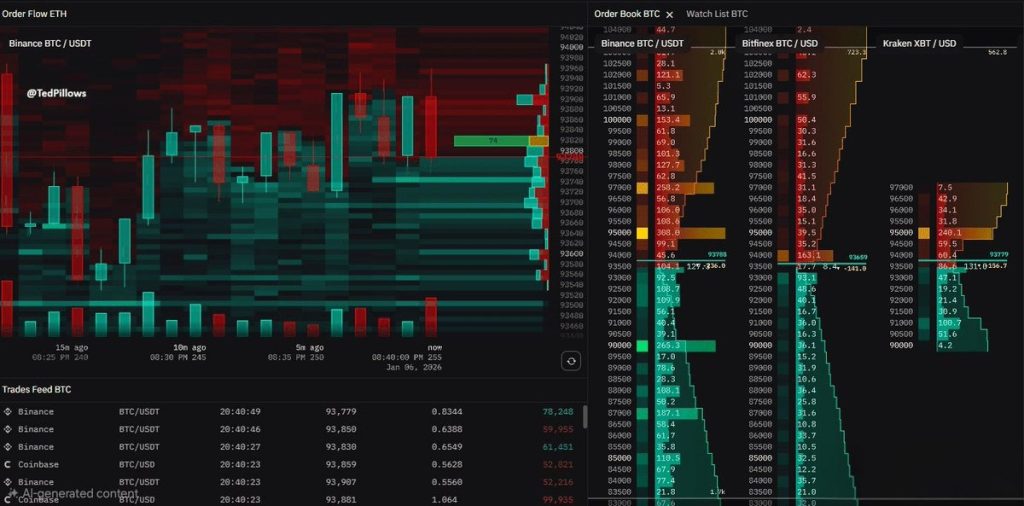

Order Flow Reveals Heavy Resistance Overhead

While the broader setup remains constructive, short-term obstacles are clear. Order-book data shows dense sell-side liquidity clustered between $94,500 and $96,000 across major exchanges. These sell walls have repeatedly absorbed buying pressure, explaining why Bitcoin has struggled to hold above $94,000 despite multiple attempts.

Buyers are active, but cautiously so. Trade data shows demand stepping in mainly on pullbacks rather than aggressively chasing breakouts. This push-and-pull has trapped Bitcoin in a narrow range, creating a compression phase marked by choppy, low-conviction trading.

Unless the market can decisively absorb supply above $95,000, upside progress is likely to remain slow.

Key Levels to Watch Into Q1 2026

In the near term, $92,000 is the line in the sand. A clean break below it could open the door to a deeper pullback toward $90,400 or even the high-$88,000 area, where buyers previously emerged. On the upside, a sustained move through $95,000 could shift momentum quickly toward $98,000 and the psychological $100,000 zone.

Looking ahead, Dixon expects January to remain volatile and range-bound. February could bring renewed upside momentum, while March may offer a shot at revisiting record highs if buying pressure builds.

Beyond technicals, institutional activity continues to underpin Bitcoin’s longer-term outlook. Major financial firms are expanding crypto offerings, with new trust products and custody services signaling deeper integration into traditional finance. These moves add structural support, even as short-term price action remains contested.

Also Read: Bitcoin Bulls Surge: Whales and Institutions Spark $100K Rally?

Bitcoin’s recent pullback reflects hesitation, not collapse. Heavy resistance overhead is slowing progress, but strong support below and steady institutional interest suggest the market is consolidating for its next move. Until a key level breaks with conviction, traders should expect volatility — and patience.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.