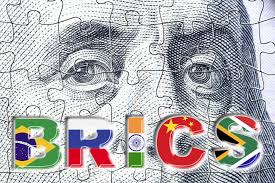

- BRICS is accelerating efforts to reduce dependence on the US dollar.

- Economic growth in emerging markets is shifting global financial power.

- The dollar may face gradual erosion rather than sudden collapse.

The US dollar has survived countless predictions of collapse. From oil shocks to financial crises, the greenback has remained the backbone of global trade. But a growing bloc of emerging economies is now challenging that dominance in a way the world hasn’t seen before. According to financial author Robert Kiyosaki, the BRICS alliance may be laying the groundwork for a future where the dollar slowly loses its reserve currency status.

While such warnings are not new, the geopolitical and economic dynamics surrounding BRICS suggest this time could be different.

Why BRICS Is Targeting Dollar Dependence

BRICS — Brazil, Russia, India, China, and South Africa — has steadily expanded its economic cooperation with a shared goal: reducing reliance on the US dollar in trade and reserves. Currency swaps, local settlement agreements, and discussions around alternative payment systems have all gained traction in recent years.

Kiyosaki argues that this shift is driven by growing frustration among developing nations. Sanctions, political pressure, and exposure to US monetary policy have pushed many countries to explore non-dollar options. As geopolitical tensions rise, local currencies and bilateral trade arrangements are increasingly viewed as safer and more independent alternatives.

Historical Pushback and Why This Case Is Different

In the past, attempts to move away from the dollar faced swift resistance. Kiyosaki points to historical examples where oil pricing in alternative currencies was short-lived, often followed by political or military intervention. Those efforts, he argues, came from isolated states with limited leverage.

BRICS, however, is not a fringe coalition. Its members represent major energy producers, manufacturing hubs, and fast-growing consumer markets. Unlike earlier challengers, these countries possess significant economic and military influence, making direct confrontation far less feasible.

This difference, Kiyosaki suggests, limits Washington’s ability to defend the dollar through traditional means.

Growth Shifts Add Pressure to the Dollar System

Another factor strengthening BRICS’ position is economic momentum. Emerging markets within the bloc continue to post stronger growth rates than many Western economies. In contrast, several G7 nations face sluggish expansion and rising debt burdens.

While the US dollar still dominates global reserves and trade settlement, reserve status is ultimately built on trust and stability. If large economies steadily reduce dollar exposure, the impact may unfold gradually — but meaningfully — over decades rather than years.

Despite the warnings, most analysts agree the dollar is unlikely to fail suddenly. Its liquidity, infrastructure, and legal framework remain unmatched. However, Kiyosaki’s argument centers on erosion, not collapse. A world with multiple reserve currencies would mark a historic shift, even if the dollar remains influential.

Also Read: Did John Cena Really Buy SHIB? And the Truth About 50 Cent’s Bitcoin

The BRICS strategy highlights a broader trend: global finance is becoming more fragmented. Whether that leads to a diminished dollar or simply a more balanced system remains one of the defining economic questions of the coming decades.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.