- LINK remains above long-term support despite falling volume.

- XRP is retesting post-breakout support from a falling wedge pattern.

- Both assets need stronger momentum for clear trend confirmation.

Chainlink (LINK) and XRP are both trading near technically important zones, drawing close attention from analysts and short-term traders. While the broader crypto market remains cautious, price structures on both assets suggest that the next directional move could be significant once conviction returns.

Chainlink Holds Long-Term Support Amid Fading Activity

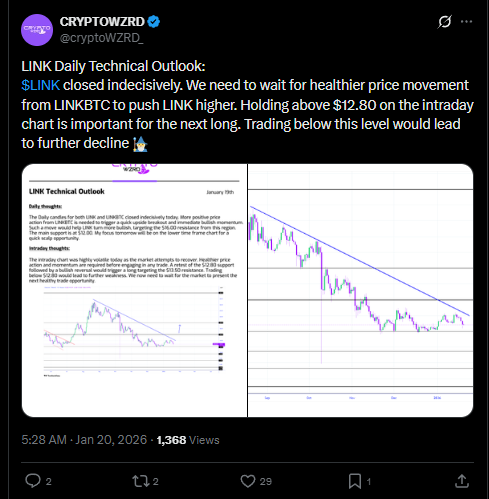

Chainlink began the week hovering near a long-standing support area, with price action reflecting balance rather than momentum. LINK is trading around $12.60, down just over 1% on the day, while daily trading volume has dropped sharply to about $320 million, signaling reduced speculative interest.

Despite the slowdown, analysts continue to highlight a constructive higher-timeframe structure. Long-term charts show LINK holding above key Fibonacci support levels, with higher lows forming since the 2021 peak. This setup suggests accumulation rather than distribution, especially as price remains well above the $10–$7 demand zone identified by several market observers.

On-chain data reinforces this view. Wallet tracking indicates that larger holders have gradually increased exposure below $13, while smaller traders have shown more reactive selling during volatility. This divergence is often interpreted as a transfer of supply into stronger hands.

Key Resistance Still Defines LINK’s Upside Case

From a technical perspective, LINK’s bullish thesis remains intact as long as it stays above major retracement support. Analysts point to $25–$31 as a decisive resistance band that could unlock a broader expansion phase if broken with volume. However, declining open interest and neutral funding rates suggest leveraged traders lack confidence for now.

In the short term, intraday levels near $12.80 are being closely watched. A sustained move below that area could delay upside attempts and extend consolidation.

XRP Tests Post-Breakout Support From Falling Wedge

XRP is facing a similar moment of uncertainty after retesting a former falling wedge resistance. The token is trading near $2.02, with modest losses on the day and steady but unspectacular volume around $4.1 billion.

Also Read: XRP Set to Explode? $2 Support Could Trigger Big Surge

The falling wedge pattern, often associated with trend reversals, has already broken to the upside. The focus now is whether the old resistance can hold as support. So far, price action suggests consolidation rather than rejection, though momentum indicators remain mixed.

For both LINK and XRP, the message is the same: structure matters, but confirmation is missing. Until volume and momentum return, traders are likely to remain patient, watching support zones, whale behavior, and key resistance levels for clues about the next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. CoinBrief.io is not responsible for any financial losses.