Dogecoin’s price has seen a significant decline from $0.431 to $0.171, yet network activity tells a different story. Between late February and early March, the number of active addresses surged to 395K, up from just 97K, signaling a peculiar market trend.

Rising Address Activity Amid Falling Prices

The sharp increase in active addresses suggests that investors are accumulating DOGE at lower prices, potentially positioning themselves for a future price rebound. The surge in network traffic aligns with heightened community engagement and social media activity, which have historically influenced DOGE transactions.

Despite this, the rising address count did not translate into an immediate price recovery. Large holders’ fund movements may have contributed to the increased activity, but they did not exert direct influence on DOGE’s price action. This divergence between network engagement and market value suggests that transaction activity alone does not always dictate price movements.

Price Action and Historical Comparisons

On March 14, 2025, active addresses dropped sharply to 55K, while the price remained stable at $0.171. This disconnect mirrors past instances where accumulation phases preceded strong rallies.

Analyzing DOGE’s weekly price action, a dragonfly doji pattern has emerged—similar to 2017—when DOGE saw a meteoric rise from $0.0006 to $0.01. The current price action at $0.171 hints at a possible reversal that could push DOGE back to $0.431 or higher, echoing the 2017 market cycle.

However, unlike the extended accumulation phase in 2017, the recent decline from $0.431 has not yet reached equivalent depths. If selling pressure persists, DOGE could test the $0.1 support level before any potential recovery.

Market Sentiment and Future Outlook

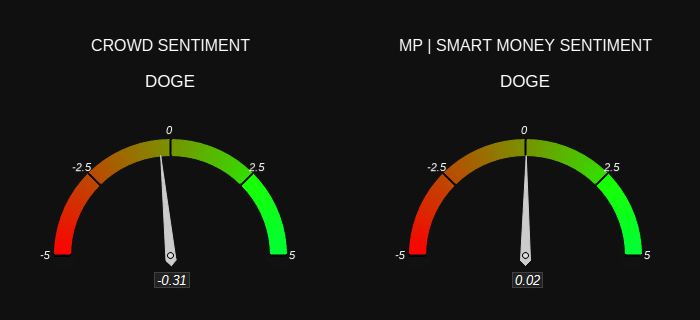

Market sentiment around DOGE remains mixed. Crowd sentiment sits at -0.31, indicating a slightly bearish to neutral stance, while smart money sentiment holds a marginally positive reading of 0.02. This suggests a cautious market outlook with no strong selling pressure.

A rebound from $0.171 remains possible, especially with the formation of the dragonfly doji. However, traders should remain vigilant, as additional bearish trends could still drive DOGE lower before a definitive upward move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.

Also Read: Dogecoin Price Prediction: Analyst Foresees 11,811% Surge to $20 – Is a Massive Rally Ahead?