Key Takeaways:

- Goldman Sachs’ Kunal Shah warns that shorting the U.S. dollar could lead to major losses.

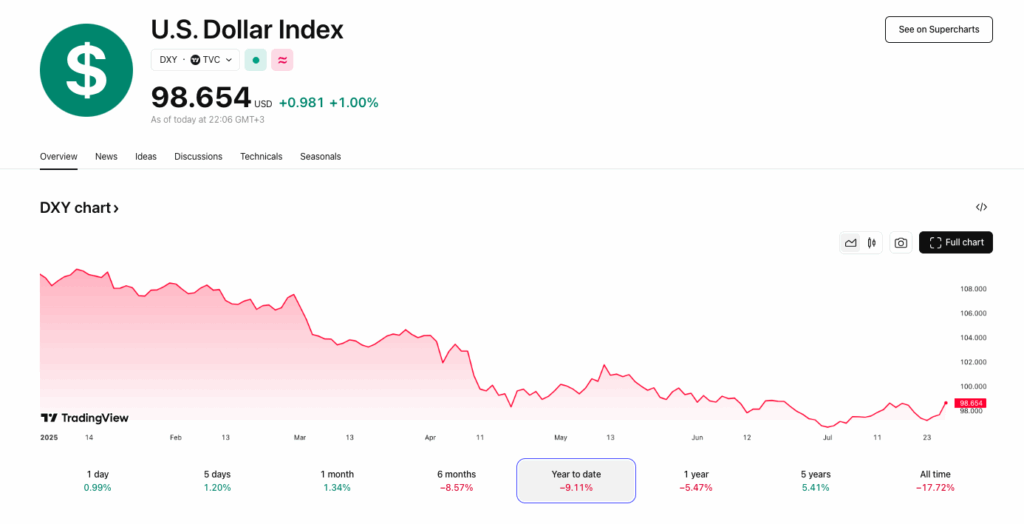

- The DXY index is down 9.5% YTD, but strong earnings and policy clarity support the greenback.

- Shah cites U.S. resilience, deregulation, and AI momentum as key reasons not to bet against the dollar.

Despite the U.S. dollar’s year-to-date slump and increasing pressure from global currency traders, Goldman Sachs’ Kunal Shah says shorting the dollar could prove costly. The Co-CEO of Goldman Sachs International (GSI) believes recent market dynamics and macroeconomic resilience reinforce the greenback’s strength — and a pullback could leave dollar bears exposed.

Dollar Declines, But Fundamentals Hold

The U.S. Dollar Index (DXY) has slipped nearly 9.5% year-to-date, trading between the 96–98 range — its lowest in three years, according to TradingView. Yet, Shah argues that the dollar’s recent underperformance doesn’t warrant pessimism. “While U.S. exceptionalism is under question,” he said, “the dollar’s prospects remain solid.”

His comments challenge a growing sentiment in currency markets that sees the dollar as vulnerable amid trade tensions, Fed policy shifts, and global diversification. But Shah emphasized that U.S. financial markets have shown notable resilience, especially since April’s sharp downturn.

Strong Earnings Underscore Market Resilience

Citing a “phenomenal recovery” since April’s market chaos, Shah pointed to exceptionally strong corporate earnings as a critical driver of renewed confidence. Major U.S. companies have consistently outperformed expectations, helping fuel a robust risk-asset rally.

“The last few months have very much told us all — do not try and bet against the U.S. dollar,” Shah noted. He warned that despite the greenback’s recent weakness, it remains underpinned by enduring economic strength and investor confidence.

Policy Clarity and Deregulation Provide Support

Shah also credited emerging policy certainty, deregulation trends, and the accelerating AI investment boom as key factors grounding the U.S. economy and, by extension, the dollar. “The range of outcomes narrowed and policy certainty on many key things returned,” he said, pointing to the fading impact of earlier instability.

He believes the confluence of strong earnings, a resilient policy backdrop, and tech-driven optimism has created a foundation that short sellers may underestimate.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.