Ethereum [ETH] has faced intense selling pressure as whales offloaded over 440,000 ETH in the past week, causing significant market shifts. Notably, a single wallet sold 8,074 ETH at an average price of $2,431, while another transferred 10,000 ETH worth $23.44 million to Binance within two days.

Whales are panic-selling $ETH!

— Lookonchain (@lookonchain) February 27, 2025

0xc725…839d sold 8,074 $ETH($19.63M) at an average price of $2431 12 hours ago.

0x07Fe…A26D deposited 10,000 $ETH($23.44M) to #Binance in the past 2 days.

Address:

0xc725102508c2f7df5bdb5f8ea5242ae18b8a839d… pic.twitter.com/3MdDnHwW9n

As a result, Ethereum’s price has tumbled, standing at $2,354.64 at press time, marking a 5.46% drop in just 24 hours. The large-scale panic selling has sparked concerns about further declines, but some investors remain optimistic that ETH could find support at current levels.

Market Sentiment: A Mixed Picture

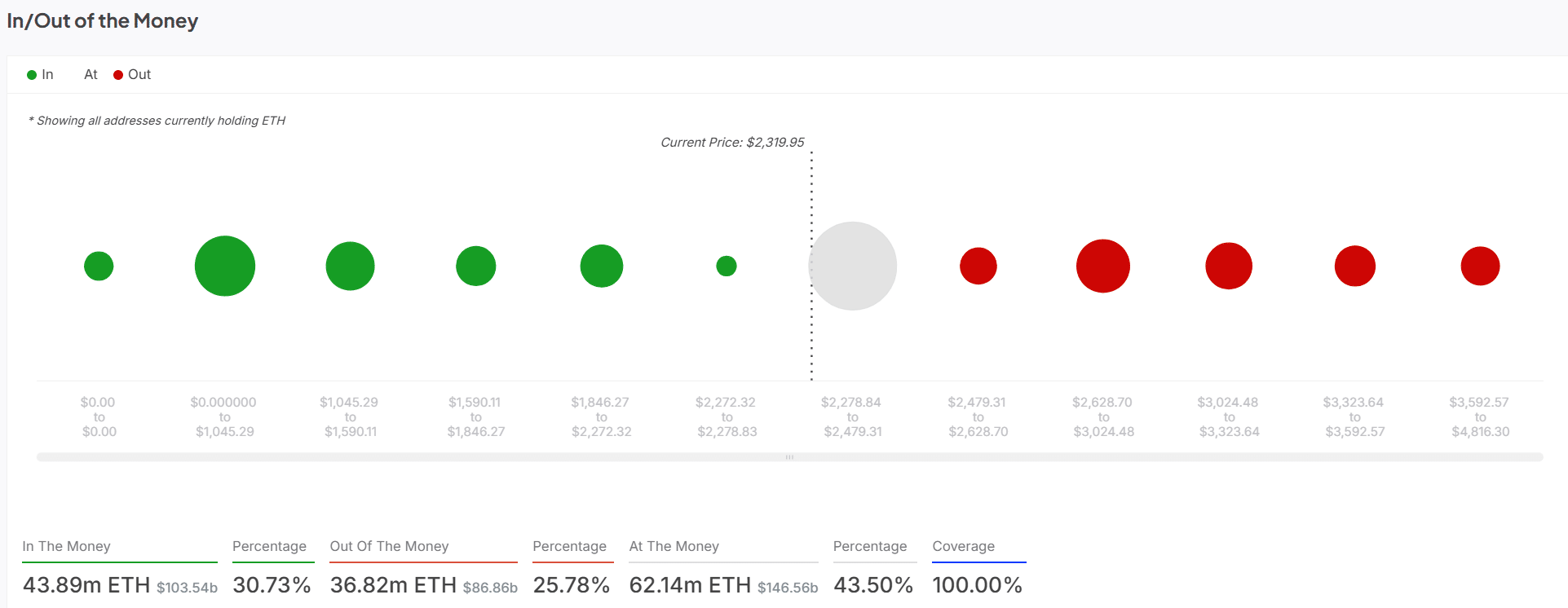

Ethereum’s in/out-of-the-money data reveals a crucial insight into investor sentiment. At present, 43.5% of ETH addresses are “in the money,” with a concentration between the $2,479.31 and $2,628.70 price levels. However, a significant 36.82% of addresses are “out of the money,” particularly those holding ETH purchased between $2,479.31 and $3,024.48. This suggests that a large portion of investors are at a loss, potentially increasing selling pressure if Ethereum’s price continues to fall.

ETH Price Action: Support or Further Drop?

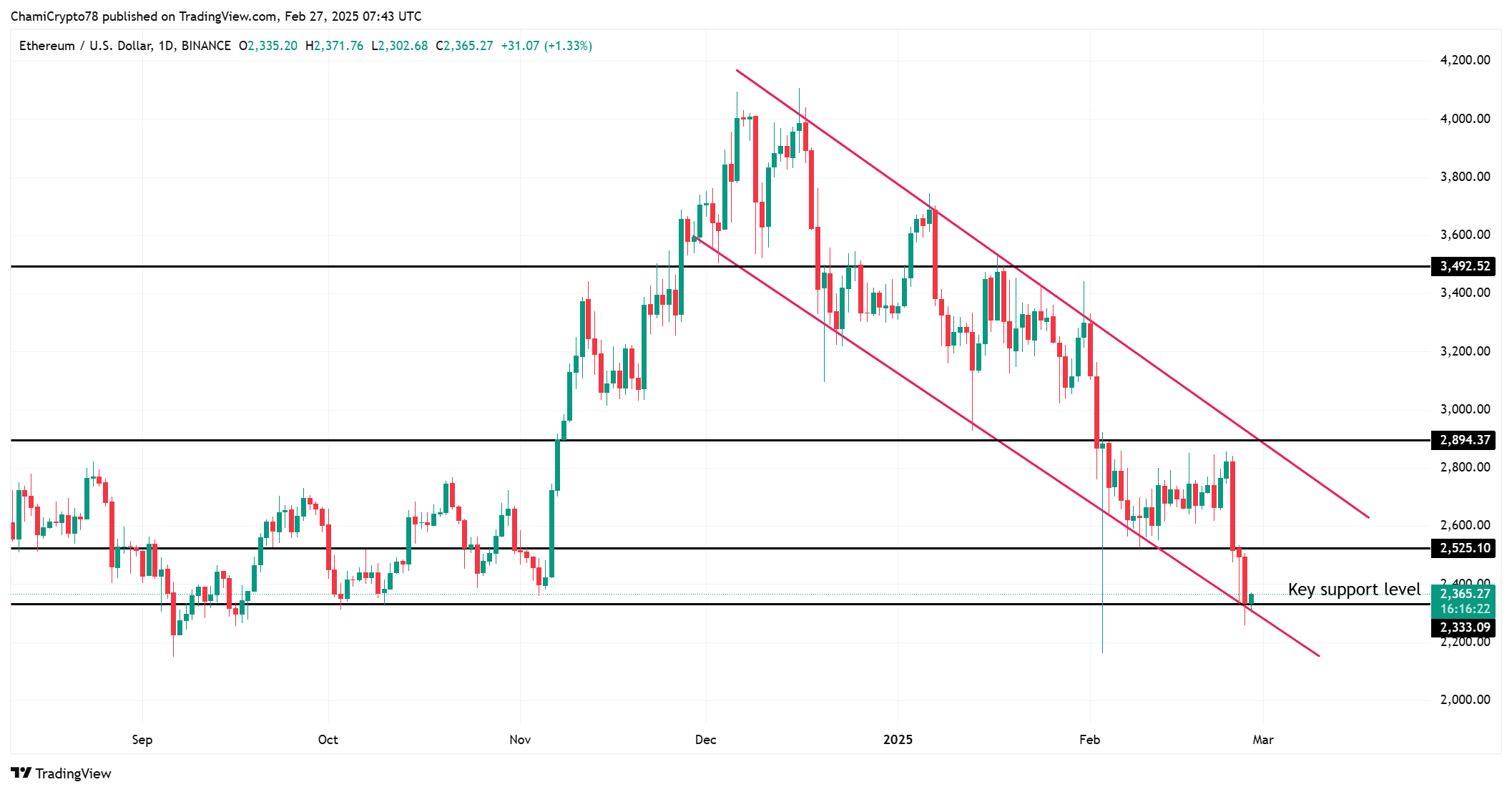

Ethereum has been testing critical support at $2,347.21. A breakdown below this level could lead to further declines toward the next key support at $2,272.32. However, ETH has recently bounced off the $2,347.21 zone, indicating that support remains intact for now.

On the upside, ETH faces strong resistance at $2,479.31. A breakout above this level could signal a trend reversal, bringing renewed confidence to investors.

Network Activity Remains Strong

Despite the bearish price action, Ethereum’s network activity remains steady. Active addresses have increased by 1% in the past 24 hours, reaching 21,283.3K, while transaction volume has risen by 0.96%. This suggests that while market sentiment is shaky, investor engagement remains robust, hinting at potential recovery if confidence returns.

Also Read: Ethereum Price Stuck in Limbo: Will Bulls or Bears Take Control?

The recent sell-off may be partially linked to the Bybit hack, which saw $1.4 billion worth of ETH affected, fueling market uncertainty. However, given Ethereum’s resilience and strong fundamentals, a rebound remains likely if key support levels hold.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.