The price of Pi Network’s native token, PI, has skyrocketed by 54.4% in the past 24 hours, reaching a new all-time high (ATH) of $3. This surge has fueled speculation that PI could soon hit $4. However, technical indicators suggest that a market correction may be on the horizon.

PI’s Explosive Growth and Market Trends

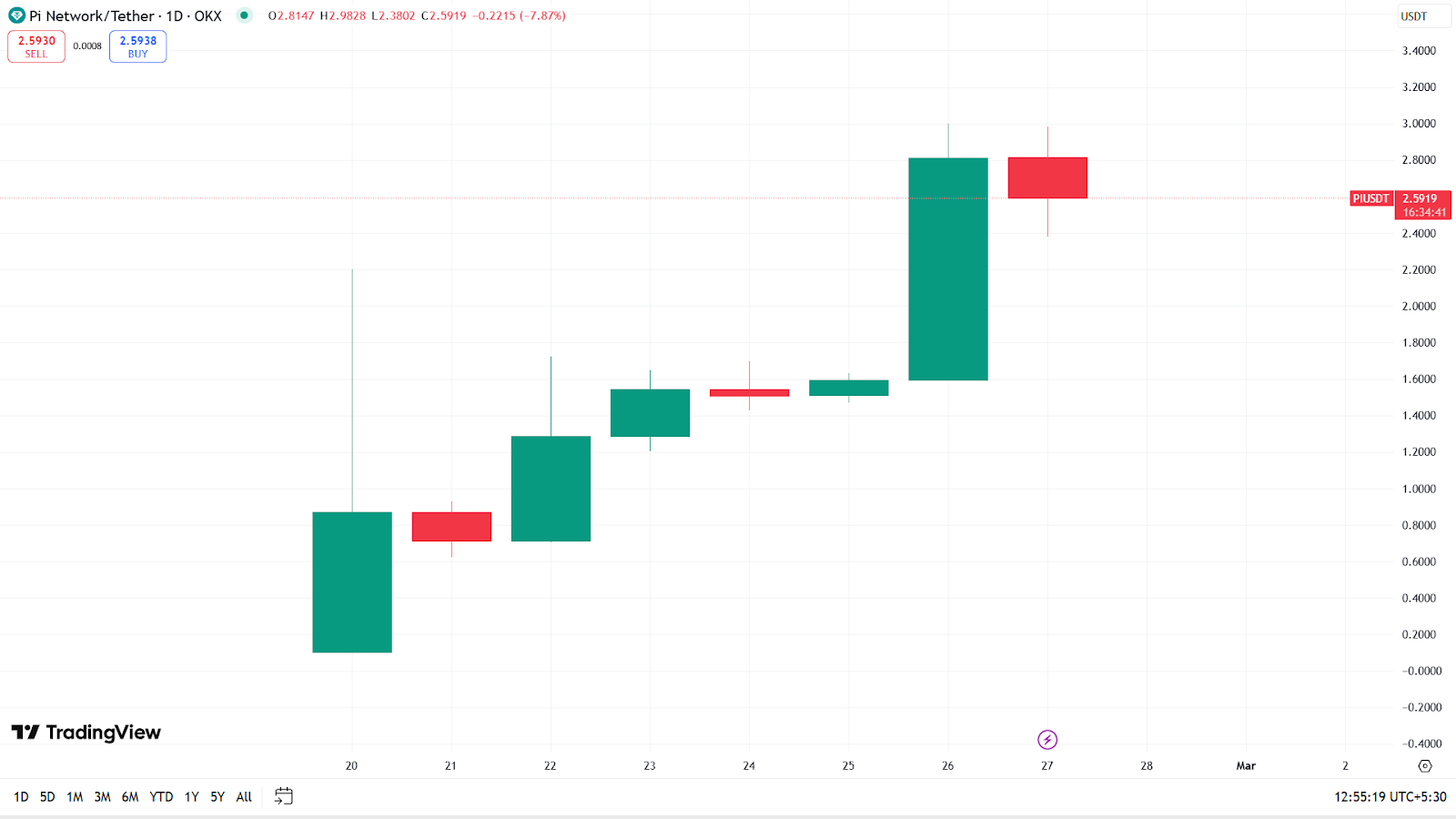

PI started February 20 at just $0.1008 before experiencing an extraordinary single-day surge of 765.87%, peaking at $2.208. A brief correction followed, with early investors cashing in profits, leading to a 17.55% decline. Between February 22 and 25, PI rebounded by 121.94% but failed to surpass its previous ATH.

Yesterday’s rally, which saw a 76.01% increase in a single day, shattered the previous ATH, establishing a new record at $3. This impressive price action has caught the attention of analysts, who predict further gains while cautioning against potential corrections.

Technical Indicators: Bullish Momentum vs. Correction Risks

DMI Indicates Strong Uptrend

The Directional Movement Index (DMI) on PI’s four-hour chart suggests robust bullish momentum. The Average Directional Index (ADX) stands at 59, with the Positive Directional Index (+DI) at 36.88 and the Negative Directional Index (-DI) at 5.92. These readings indicate that buying pressure remains significantly stronger than selling pressure, reinforcing the bullish outlook.

BBTrend Signals Potential Pullback

Despite the strong uptrend, the BBTrend indicator on PI’s two-day chart has dropped sharply to -9.1491, down from a reading above 50 on February 24. The Bollinger Bands show the upper band at $3.1846, the baseline at $2.1894, and the lower band at $1.1936, suggesting that PI could be overextended and due for a correction.

Also Read: Pi Network Price Skyrockets 157% – Can It Hit $5 Before March 31?

Experts believe that if PI maintains its upward momentum and breaks the $3.5 resistance level, it could climb to $4. However, if selling pressure increases, a decline to $1.7 or even $0.79 is possible. Traders should monitor key support and resistance levels closely as PI navigates this volatile phase.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.