As the cryptocurrency market awaits decisive regulatory clarity on several ETF applications, two prominent digital asset funds—Polkadot (DOT) and Hedera (HBAR)—are now under the spotlight. The U.S. Securities and Exchange Commission (SEC) has delayed its rulings on both ETF proposals, seeking further public input and pushing decisions beyond the second deadline.

Grayscale’s proposed Polkadot ETF and Canary Capital’s Hedera ETF were both up for review. However, rather than issuing a verdict, the SEC has opened a new window for public commentary. This strategic delay shifts the third deadline to September 9, with final decisions expected by November 8. The SEC also postponed its response to the Canary Spot SUI ETF, adding to the mounting uncertainty around digital asset funds.

Bloomberg ETF analyst James Seyffart weighed in on the matter, predicting that approvals for these crypto ETFs are unlikely to materialize before Q4 2025. Fellow analyst Eric Balchunas echoed this view, speculating that while active crypto ETFs might emerge by winter 2025, niche products like memecoin-only ETFs may not arrive until 2026.

Currently, Grayscale is the only applicant for a Polkadot ETF, while both Grayscale and Canary Capital are vying for HBAR ETFs. Notably, Canary Capital submitted its application before Grayscale, potentially giving it a competitive advantage—if the SEC reinstates the ‘first-to-file’ approval model.

Several industry players, including VanEck, 21Shares, and Canary Capital, have urged the SEC to return to this first-come-first-served approach, arguing that it would boost fairness and innovation in the ETF space. So far, the Commission has not responded to this suggestion.

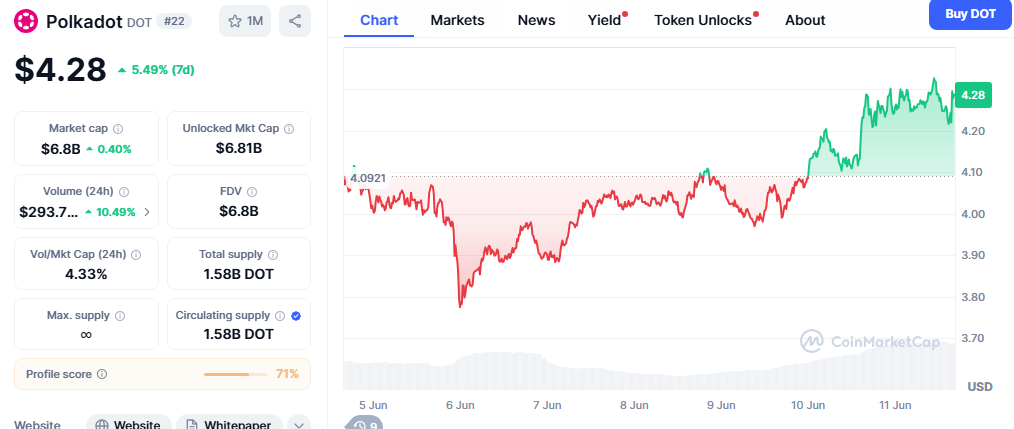

Despite the ongoing regulatory uncertainty, market reactions to the delays have been relatively subdued. As of the latest update, DOT traded at $4.30, posting a 4.52% gain in 24 hours, while HBAR rose 1.65% to $1.798. The price action suggests that investor sentiment remains stable, even as ETF prospects remain in limbo.

Also Read: Polkadot (DOT) Price Surges Ahead of SEC ETF Decision — Is a Breakout Imminent?

With the next deadline looming and the crypto industry continuing to push for reform, all eyes are now on the SEC’s next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.