Polkadot’s native token, DOT, has experienced a notable uptick in trading activity and price performance ahead of a key regulatory decision by the U.S. Securities and Exchange Commission (SEC). Since the weekend, DOT has posted steady gains as market participants anticipate the SEC’s June 11 ruling on Grayscale’s Polkadot ETF application. A second decision, involving 21Shares’ Polkadot ETF, is due on June 24.

This surge in investor interest is closely tied to optimism that a favorable ETF ruling could drive broader institutional adoption. At press time, DOT is trading at $4.11, reflecting a 3% gain in 24 hours, while its daily trading volume has jumped 76% to $230 million — a clear signal of rising demand and trader enthusiasm.

Bullish Indicators: DOT Nears Key EMA Level

Technical indicators are also painting a bullish picture for DOT. The token is approaching its 20-day exponential moving average (EMA), a widely-watched signal for momentum shifts. A break above this level could confirm a near-term bullish trend, particularly as DOT hovers just below the EMA with increasing buy-side pressure.

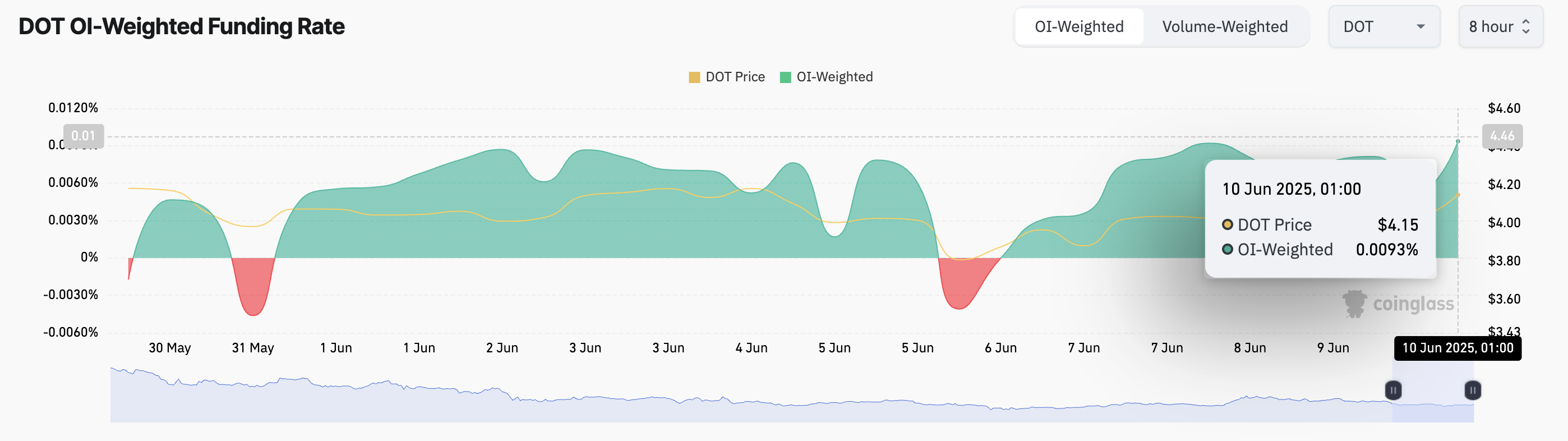

Further reinforcing the bullish narrative is DOT’s funding rate, currently at 0.0093% according to Coinglass. A positive funding rate suggests long-position traders are paying a premium, underscoring market confidence in continued upward price movement.

Market Awaits SEC Ruling — Potential for Volatility

While sentiment is currently strong, all eyes are on the SEC’s decision set for June 11. A green light for Grayscale’s Polkadot ETF could trigger a breakout above the $4.13 resistance level, potentially propelling DOT toward $4.37. However, a rejection could swiftly reverse recent gains, with support expected near $3.96.

Also Read: Polkadot (DOT) Breaks Out: Is a Bullish Reversal Toward $6.45 in Play?

In the short term, DOT’s rally appears to be backed by solid fundamentals and speculative optimism. But as with all ETF-related events, regulatory outcomes can dramatically sway market direction. For now, DOT remains a token to watch in the days ahead.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.