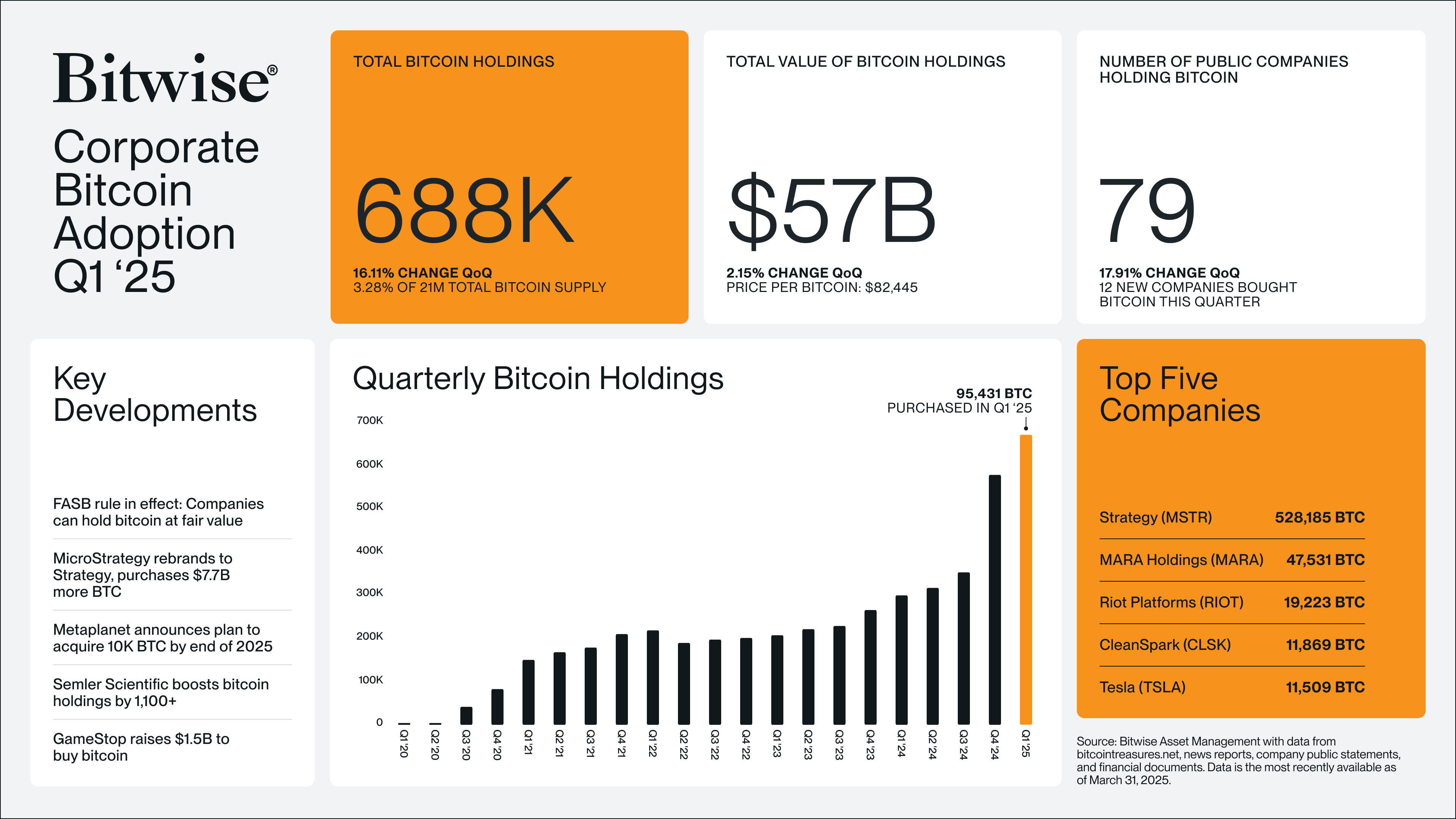

The corporate appetite for Bitcoin is growing stronger. According to crypto asset manager Bitwise, publicly listed companies increased their collective Bitcoin holdings by 16.1% in the first quarter of 2025, adding 95,431 BTC to their balance sheets. As of March 31, the total stash held by public firms stood at approximately 688,000 BTC—worth around $56.7 billion.

Twelve new companies joined the Bitcoin bandwagon for the first time in Q1, pushing the total number of Bitcoin-holding public firms to 79. The largest first-time buyer was Hong Kong-based construction company Ming Shing, whose subsidiary Lead Benefit acquired 833 BTC in two tranches during January and February.

U.S.-based video platform Rumble also made headlines with a 188 BTC purchase in March, continuing a trend of politically affiliated platforms embracing crypto. Meanwhile, Hong Kong investment firm HK Asia Holdings made waves with a single BTC buy in February—sending its stock price soaring nearly 100% in one day.

Also Read: Glassnode Flags Critical BTC and ETH Levels: $83.5K Resistance, $1,461 Ethereum Support

Japan’s Metaplanet, already a known Bitcoin advocate, made another bold move. The Tokyo-based firm acquired 319 additional BTC at an average price of $82,770, bringing its total holdings to 4,525 BTC—valued at approximately $383.2 million. Despite a slight dip in share price after the announcement, Metaplanet now ranks as the tenth-largest public Bitcoin holder globally, just behind Jack Dorsey’s Block, Inc.

Bitcoin itself is currently trading near $84,440, up roughly 2.3% since the end of Q1, having bounced back from early April lows following global tariff concerns.

The continued corporate accumulation signals growing confidence in Bitcoin as a treasury asset amid economic uncertainty. Bitwise’s data suggests that institutional adoption is no longer a fringe trend—it’s accelerating.

As more publicly listed firms embrace Bitcoin, the spotlight remains on how these strategic buys may reshape the financial landscape—and influence crypto market stability moving forward.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.