TRON (TRX) saw a notable rebound after dipping below $0.22, climbing over 10% in the past three days to trade at $0.232 at press time. However, despite this recovery, TRX remains below the key resistance level of $0.25, raising questions about its next move.

TRON’s Range Formation Signals Caution

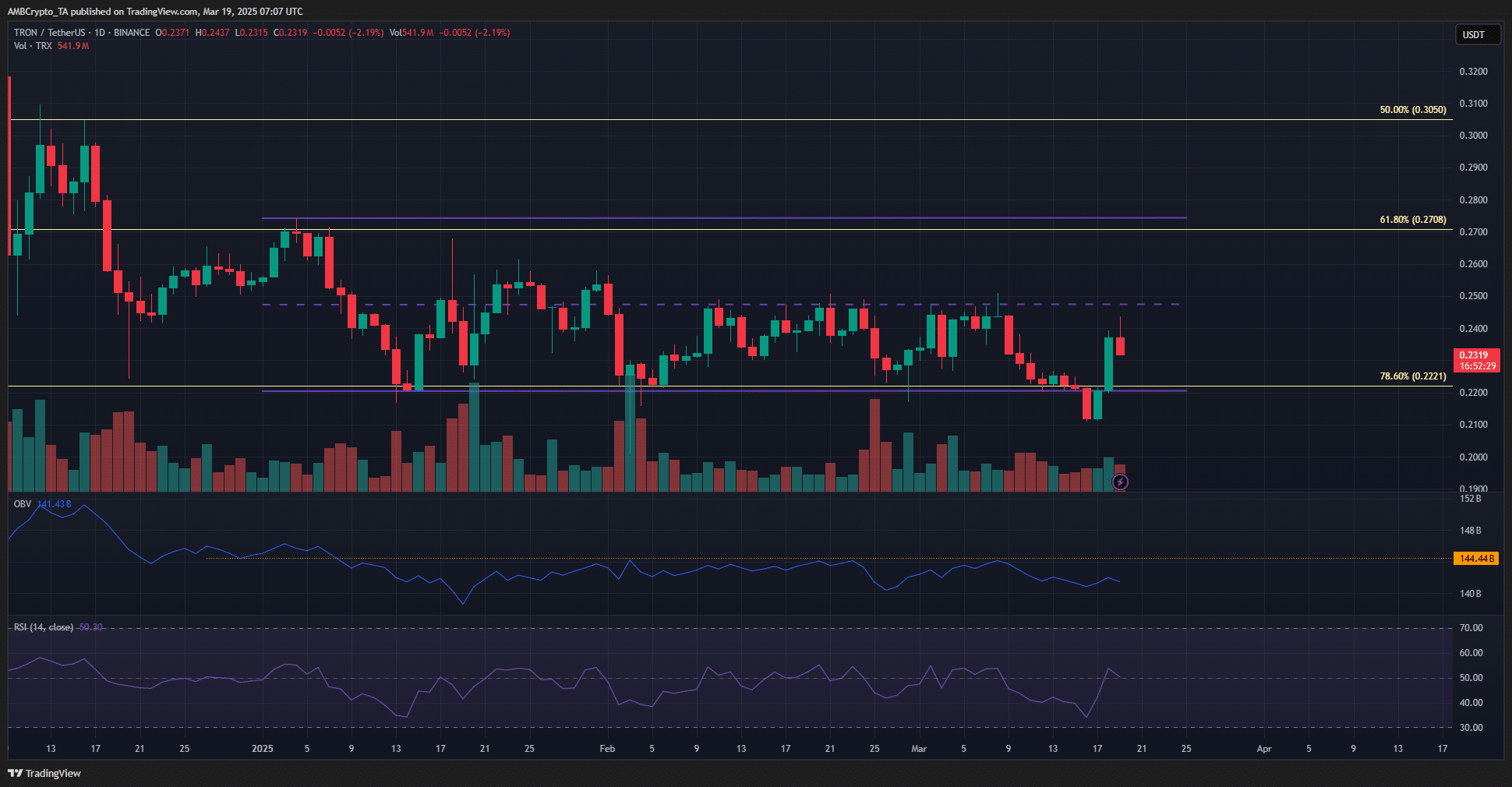

Since early February, TRON has been trapped within a well-defined trading range of $0.2745 to $0.22. The mid-range level at $0.248 has proven to be a stubborn resistance zone, preventing sustained breakouts. Each time TRX approached this level over the past six weeks, sellers gained control, leading to price declines toward the lower boundary.

The recent dip below the range low was met with a strong bullish reaction, but market indicators suggest the rally may be losing steam. The On-Balance Volume (OBV) has not yet surpassed its previous high, indicating that buying pressure remains insufficient to drive a breakout. Additionally, the Relative Strength Index (RSI) sits at 50, reflecting neutral momentum with no clear bullish dominance.

Bitcoin’s Impact and Liquidation Zones

Bitcoin’s (BTC) sideways movement around $83,000 has also influenced TRON’s trajectory. Without a decisive push from BTC, TRX may struggle to break past the $0.25 resistance.

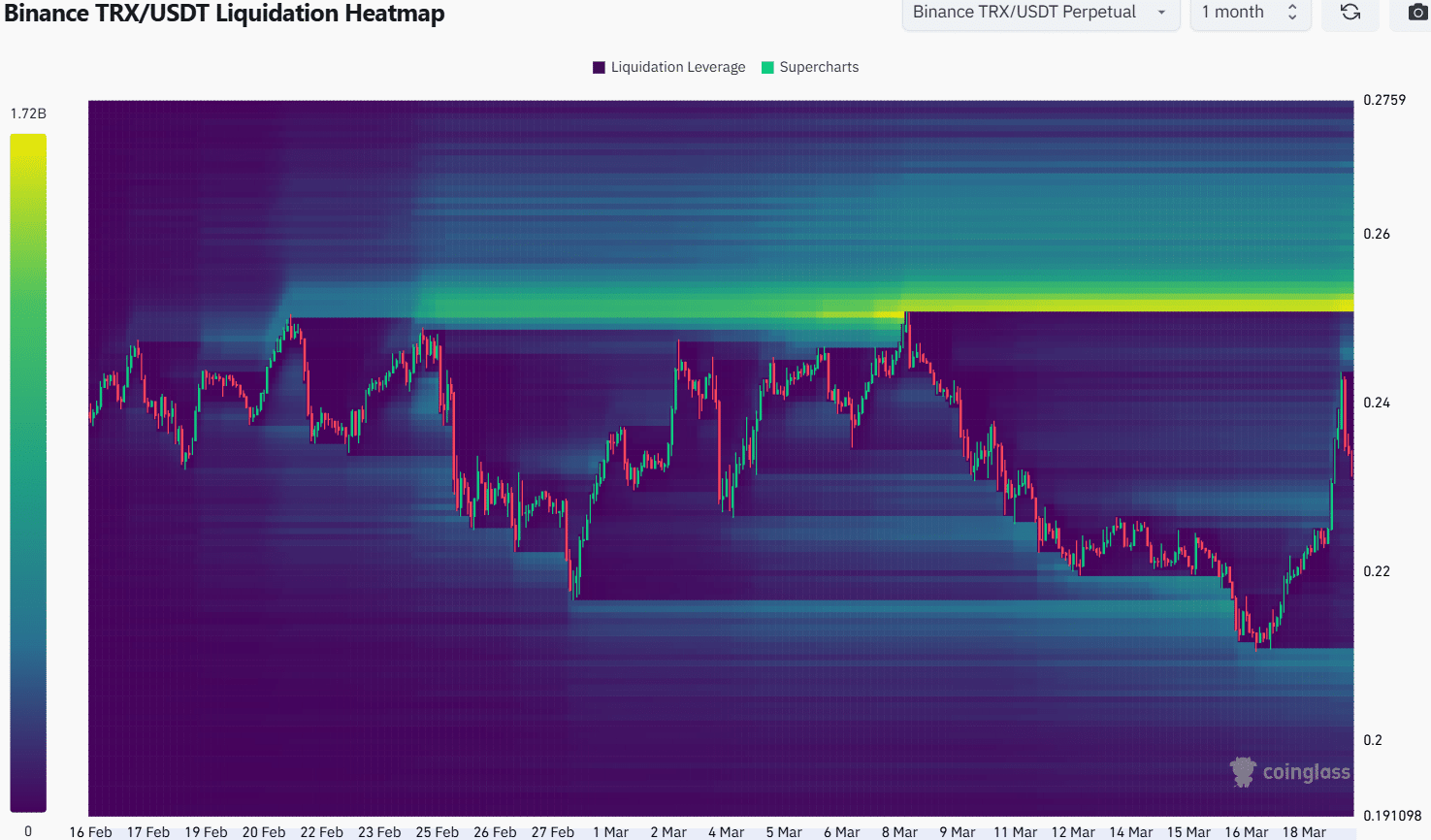

The 1-month liquidation heatmap from Coinglass highlights $0.25 as a high-liquidity zone, suggesting that traders may target this level before a potential pullback. The presence of liquidity just above the mid-range could briefly push TRX higher before sellers step in.

What’s Next for TRX?

Given the technical setup, traders may look to capitalize on a retest of the $0.25 resistance before considering short positions. The lack of strong bullish volume and previous failures to break resistance suggest that a rejection is likely.

Also Read: VeChain Unveils Galactica: Pioneering VIP Upgrades for a Stronger Blockchain Ecosystem

While the short-term outlook remains cautious, a decisive break above $0.25 could shift sentiment and open the doors for a rally toward $0.2745. Until then, traders should watch BTC’s movement closely, as any breakout in Bitcoin could provide the momentum TRX needs to defy bearish expectations.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.