TRON’s on-chain metrics have pointed to growing activity, with its gas usage ratio steadily climbing. This uptick in utility has mirrored TRX’s price rebound, suggesting a renewed alignment between network engagement and investor sentiment. Historically, such synchronicity has often preceded bullish price action. Yet, as past cycles have shown, this relationship isn’t always guaranteed to hold.

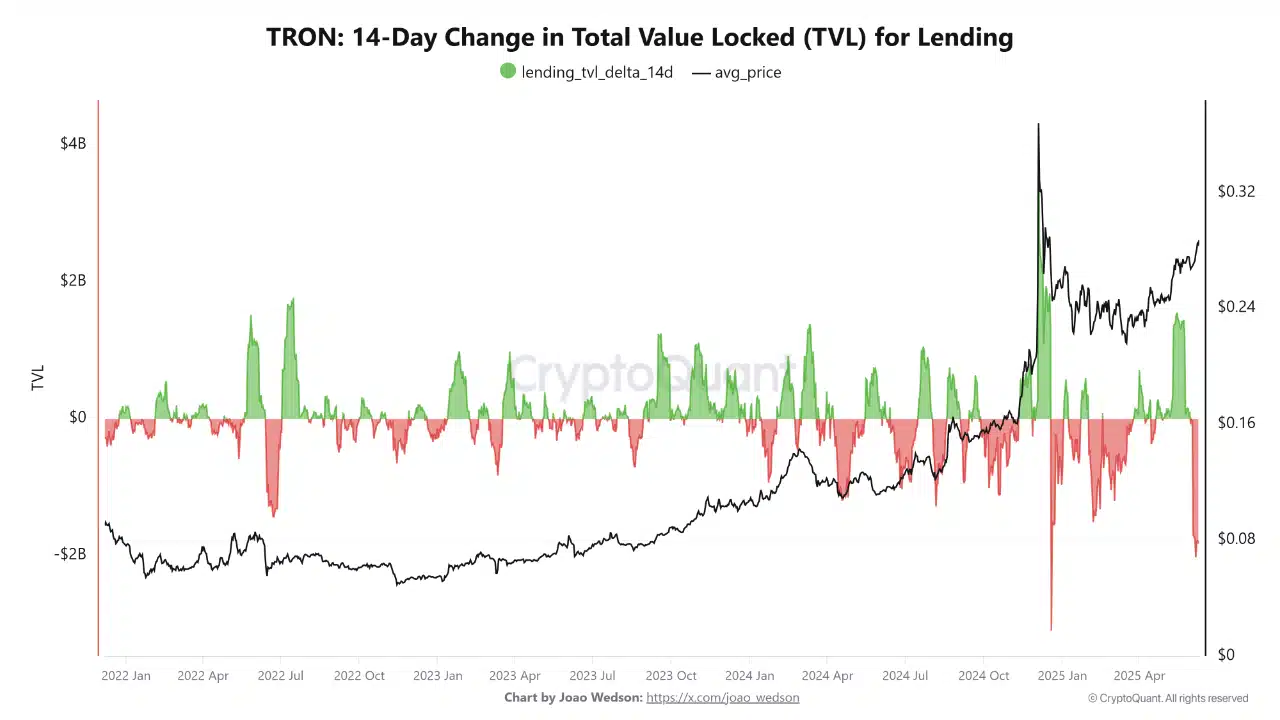

Despite TRX trading near the upper bounds of its multi-month range around $0.288, warning signs are emerging. Most notably, TRON’s lending sector has seen a sharp $2 billion decline in total value locked (TVL), pushing its 14-day delta deep into negative territory. This contraction, against the backdrop of rising prices, signals a potential decoupling. It could indicate waning borrower confidence or capital rotation away from DeFi lending—both scenarios that could eventually undermine bullish momentum.

Adding to the cautious outlook is the market’s taker volume delta. Over the last 90 days, sell orders have outpaced aggressive buys, indicating potential distribution. Without a clear shift toward dominant buying volume, the current rally may struggle to sustain itself—especially with the Relative Strength Index (RSI) hovering near 65, just below overbought territory.

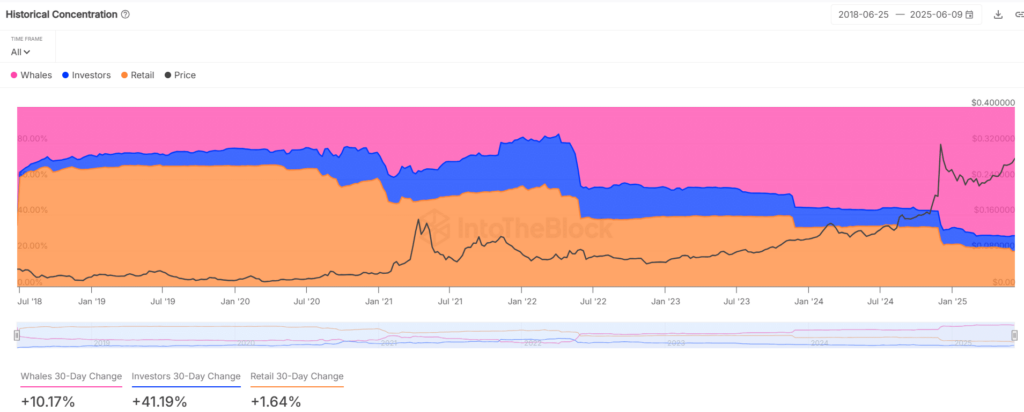

However, not all signals are bearish. On-chain data shows whales have increased their TRX holdings by over 10% in the past month, while mid-tier investors accumulated over 41%. This silent buildup suggests that larger players may be positioning for a breakout. With 92.39% of holders currently in profit, sentiment remains strong—but the risk of profit-taking looms if the price fails to break above key resistance at $0.29.

TRX has consolidated between $0.25 and $0.29 for months. A confirmed breakout with strong volume above the upper band could trigger a fresh rally toward previous highs. Yet, without decisive buyer momentum and improved lending flows, the token risks another rejection.

Also Read: TRON (TRX) Price Eyes $0.25 Resistance: Will Bulls Break Through or Face Rejection?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.