Uniswap (UNI) is approaching a crucial weekly support level at $3, a price floor that has successfully held firm since December 2020. This level has historically triggered strong bullish reactions, preventing further declines and fueling subsequent recoveries. Notable bounces have occurred in mid-2022, mid-to-late 2023, and Q4 2024, reinforcing its significance.

Bearish Momentum Evident in Technical Indicators

Despite this historical resilience, the MACD indicator currently signals a bearish trend. As of press time, the MACD line sits at -0.596, below the signal line at -0.503, with a histogram reading of -0.093. These figures suggest that downward momentum remains strong, potentially pushing UNI toward the $3 support level. However, if the price stabilizes and the histogram starts narrowing, it could indicate the beginning of bullish convergence—a possible precursor to a reversal.

A significant pattern to watch is the potential formation of a double-bottom at $3, similar to late 2024’s structure that resulted in a breakout. Should UNI repeat this trend, investors could see a strong upward move once again. Conversely, a decisive break below $3 would invalidate this support and signal a shift toward bearish territory.

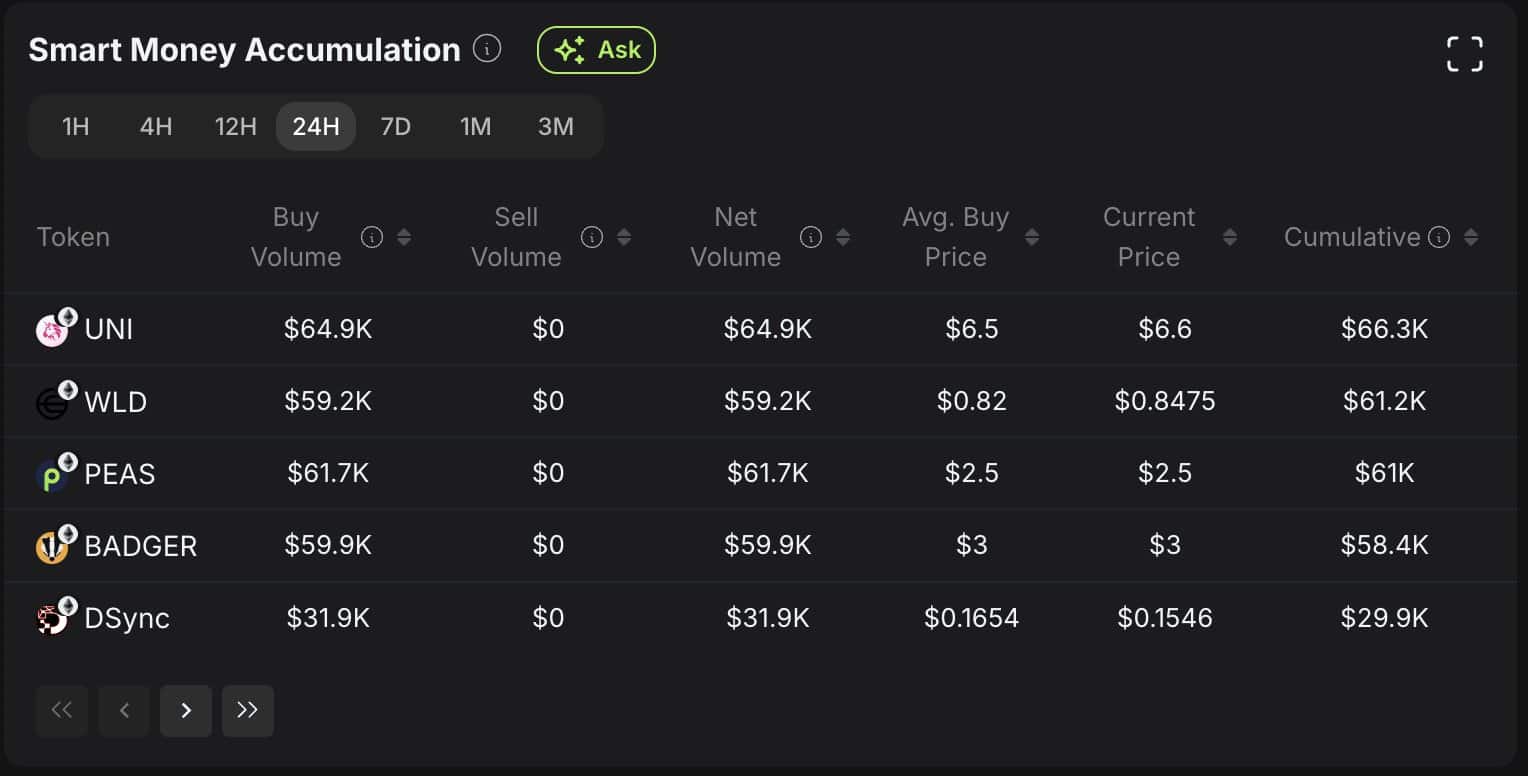

Smart Money Accumulation Points to Optimism

Recent on-chain data indicates that smart traders are accumulating UNI despite the bearish sentiment. Ethereum-based buy volume for UNI reached $64.9K, with zero sell volume, reflecting a net positive flow of $64.9K. The average buy price among these traders is $6.50, with cumulative volume climbing to $66.3K—suggesting that some investors anticipate a rebound at $3.

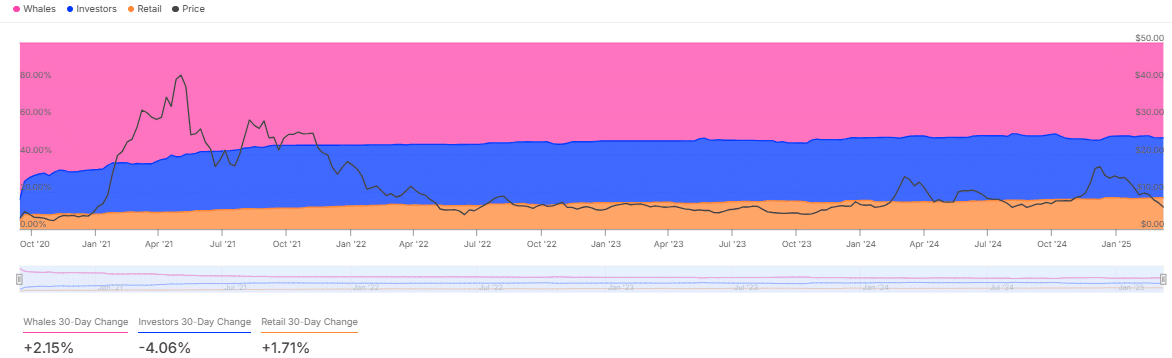

Ownership trends also reveal an intriguing dynamic: whales have increased their holdings by +2.15% over the past 30 days, signaling accumulation. Meanwhile, investors have reduced their stakes by -4.06%, likely taking profits, while retail participation has risen by +1.71%, showing moderate accumulation. This whale activity hints at underlying bullish pressure that could fuel a recovery, provided selling pressure does not overwhelm demand.

Also Read: Uniswap and Robinhood Team Up to Simplify Crypto-to-Fiat Transactions Globally

As UNI teeters on its critical $3 support, historical precedence suggests a potential rebound. Smart money accumulation and whale interest add weight to the bullish case, but failure to hold this level could see UNI enter a prolonged bearish phase. Traders should closely monitor price action and technical indicators to gauge the next move.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.