Pepe [PEPE], the popular memecoin, has begun trending upward again, notching a 2.15% gain over the last 25 hours—extending its positive momentum from the previous week. With growing market interest and bullish indicators, analysts are weighing whether this momentum can sustain, especially in light of recent whale activity.

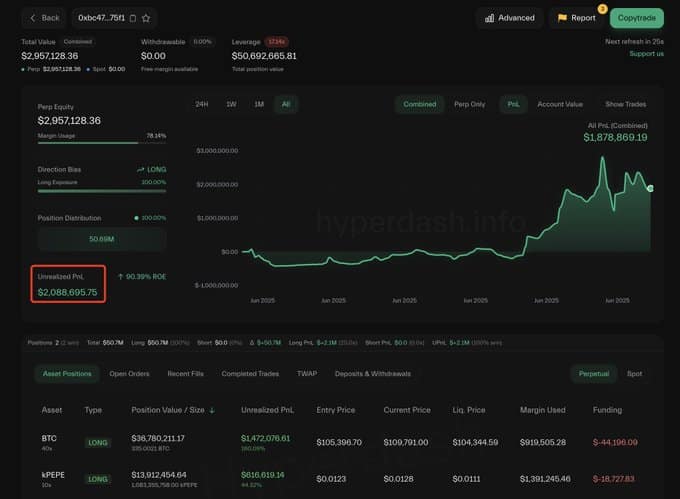

A notable driver of this uptick is James Wynn, a high-profile crypto trader infamous for recent high-stakes losses. Wynn, who was liquidated on a $99 million Bitcoin position weeks ago, has now re-entered the market with a sizable bet on PEPE. On-chain data reveals he created a new wallet and opened a long position worth $13.9 million. The position has already yielded an unrealized profit of $616,000, signaling strong early gains.

Wynn’s renewed interest in PEPE follows a previously unsuccessful $10 million position on the same asset via Hyperliquid. Given his recent track record, his move is stirring debate: is Wynn’s return a bullish indicator or a warning sign of over-leverage?

Market data, however, suggests broader support for PEPE’s rally. In the spot market, over $35 million worth of PEPE has been accumulated in the past week, continuing a multi-week trend that signals robust investor interest. Analysts interpret this as a strong signal that traders see the current price zone as a strategic entry point.

The futures market echoes this optimism. A bullish sentiment prevails, with traders increasingly opening long positions. The Open Interest Weighted Funding Rate, recorded at 0.0104%, supports this bias—indicating that long traders are paying funding fees, a sign of confidence in price appreciation.

Beyond individual sentiment, the memecoin sector as a whole is showing strength. Over the last seven days, the segment has climbed 5.8%, outperforming Bitcoin ecosystem and exchange tokens. Should this momentum continue, PEPE is well-positioned for a significant breakout.

Also Read: Whale Accumulation Sparks PEPE Price Rally: Is a Major Breakout Ahead?

As accumulation and positive derivative signals converge, PEPE could sustain its bullish trajectory. Still, with volatility in play and Wynn’s track record looming, traders remain cautiously optimistic.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.