XRP continues to trade in the red today, aligning with a broader crypto market downturn following the White House Crypto Summit. However, despite its recent volatility, analysts remain optimistic about the long-term trajectory of Ripple’s native asset. Some even suggest that XRP could mirror its historic 2017-2018 rally, which saw a staggering 700% surge.

XRP Price Target: Can It Reclaim Double Digits?

Renowned crypto analyst EGRAG CRYPTO has set two ambitious price targets for XRP. In a recent post on X, he highlighted historical breakout patterns that could guide future price action.

#XRP – 1 Month Will Change Your Life Forever ($9.7 – $27)

— EGRAG CRYPTO (@egragcrypto) March 7, 2025

🔵 The Power of Market Waves & Narratives

When @ElonMusk added #BTC to Tesla’s balance sheet last cycle, many thought all companies would follow. They didn’t. Narratives come and go, but markets move in cycles.… pic.twitter.com/dtGFQjeUE2

The first target sits at $9.7, derived from the midpoint of a triangle breakout pattern. EGRAG advises investors to consider taking profits gradually at $8, $9, and $10 rather than waiting for an exact peak. This approach mitigates risk while allowing traders to capitalize on potential price swings.

Meanwhile, the second, more ambitious target is $27, based on XRP’s explosive 2017-2018 rally. During that cycle, XRP surged by 718% from a breakout range of $0.35-$0.39. Applying the same percentage gain to the current cycle’s local high of $3.4 suggests that XRP could reach $27 per coin.

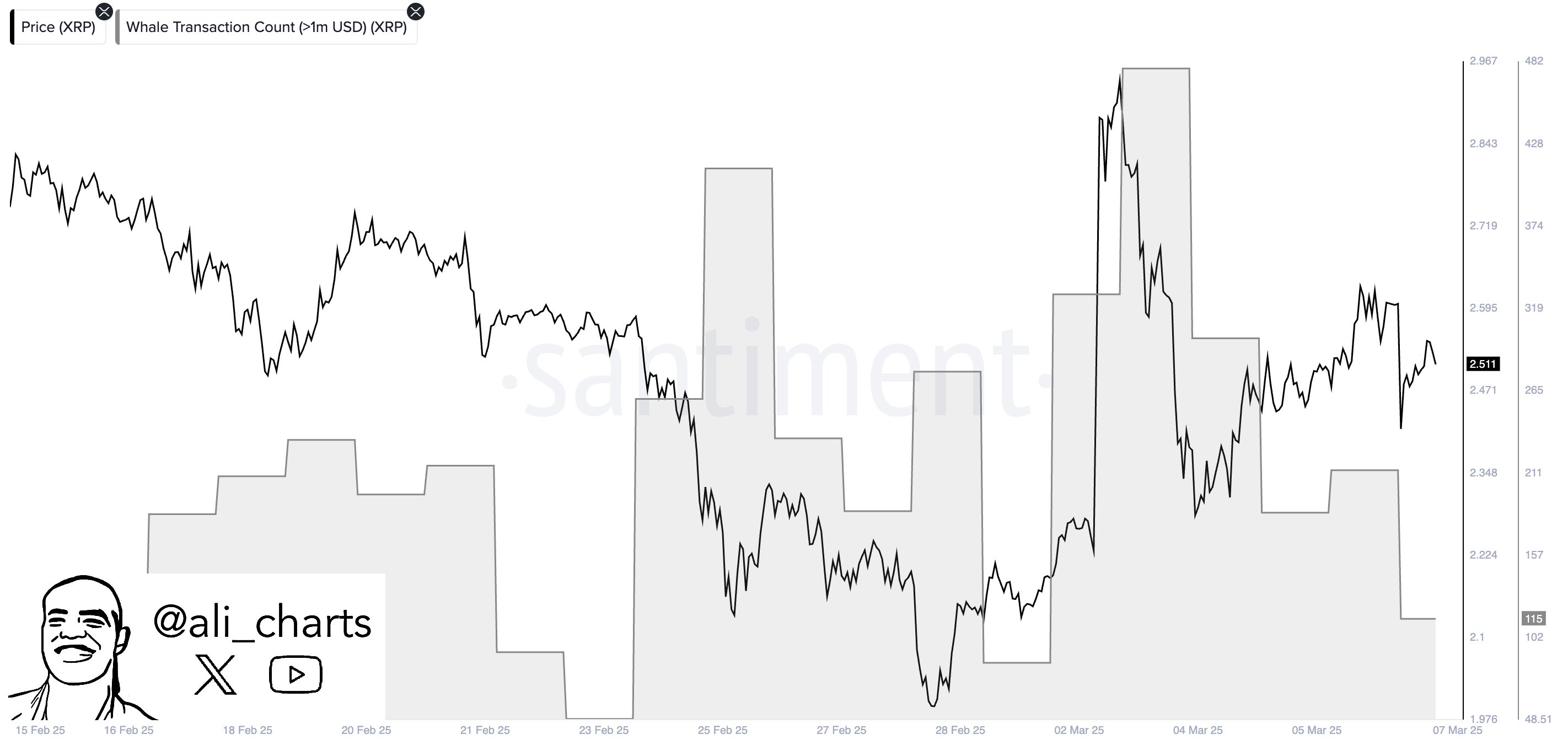

Whale Activity and Market Sentiment

EGRAG’s bold projection coincides with rising whale activity within the XRP network. Analyst Ali Martinez recently reported a notable increase in large transactions, with XRP whales moving nearly $6 billion worth of tokens over the past three weeks. While some of this activity could indicate selling pressure, the overall trend suggests increasing market participation and confidence in XRP’s future prospects.

Investor sentiment is also being driven by the ongoing Ripple vs. SEC lawsuit, with hopes that a favorable outcome could significantly boost XRP’s price. Additionally, speculation over a potential XRP exchange-traded fund (ETF) in the U.S. has further fueled optimism.

What’s Next for XRP?

At the time of writing, XRP is trading at $2.35, down 6%, with its trading volume dropping 13% to $8 billion. The asset’s futures open interest has also fallen by 4% to $3.37 billion, reflecting the prevailing market uncertainty.

However, technical analysis suggests a bullish breakout could be imminent. Ali Martinez pointed out that XRP is consolidating within a symmetrical triangle, a formation that could trigger a 23% price rally upon breakout. Similarly, analyst CasiTrades highlighted the $2.54 resistance level, noting that a decisive move above this mark could push XRP towards $2.70 and $3.05, with a long-term target of $9.50.

While short-term fluctuations persist, the broader outlook for XRP remains positive. If historical trends repeat, XRP could be on the verge of another massive rally, potentially reaching double-digit valuations in the coming months.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of CoinBrief.io. Before making any investment decisions, you should always conduct your own research. Coin Brief is not responsible for any financial losses.

Also Read: Michael Saylor Backs XRP & Cardano in U.S. Crypto Reserve Shift